Axia Futures – Wroclaw Career Programme

$3,200.00 Original price was: $3,200.00.$620.00Current price is: $620.00.

Out of stock

Axia Futures Wroclaw Career Programme Course [Instant Download]

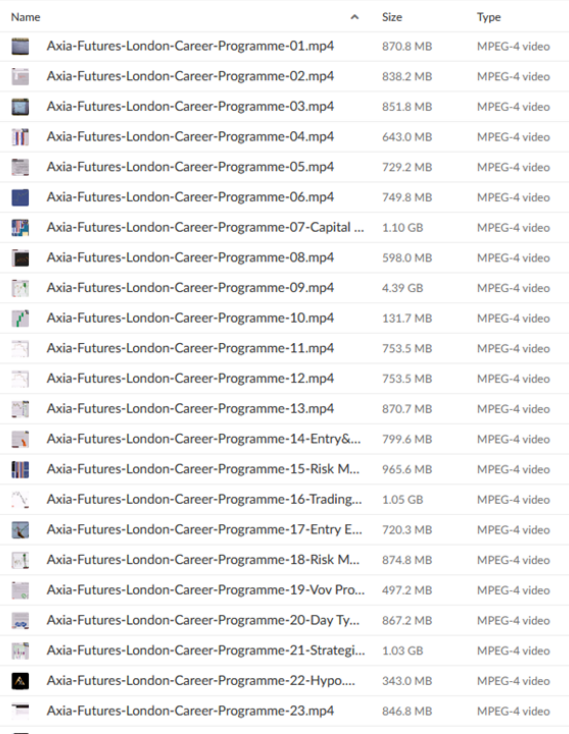

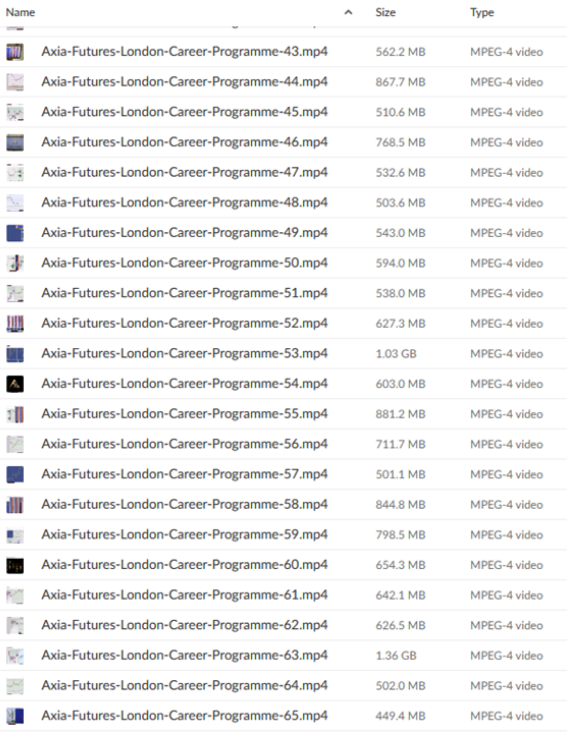

📚 PROOF OF COURSE

1️⃣. What is Axia Futures’ Wroclaw Career Programme:

The Axia Futures Wroclaw Career Programme offers an unparalleled opportunity to dive deep into the world of futures trading. This 8-week intensive course is designed to harness your trading potential through a combination of theoretical knowledge and hands-on practice on the Wroclaw trading floor. By participating, you gain real-time exposure to the dynamic trading environment, mentored by some of Europe’s top commodity futures momentum breakout traders. Whether you’re starting with basic understanding or looking to sharpen your skills, this programme is structured to build your proficiency from the ground up, culminating in the capability to make high-stakes decisions with confidence.

2️⃣. What you will learn in Wroclaw Career Programme:

In the Wroclaw Career Programme, you will:

- Understand the fundamentals of futures trading including market terms, concepts, and processes.

- Develop critical trading skills like order flow analysis, pattern recognition, and execution strategies.

- Learn to apply macro and geopolitical strategies to real-world trading scenarios.

- Enhance your trading routine with advanced techniques for market pattern recognition.

- Gain firsthand experience on an immersive trading floor, enhancing decision-making under live market conditions.

3️⃣. Wroclaw Career Programme Course Curriculum:

STAGE 1 – INTRODUCTION TO FUTURES

- Week 1: Introduction to Futures Trading

- Overview of the futures market, including key terminology and fundamental concepts.

- Detailed exploration of market mechanisms and trading logistics.

- Week 2: Introduction to Futures Trading (Continuation)

- Delve deeper into trading strategies that cater to beginner skill levels.

- Establish a robust theoretical foundation for high-level trading.

STAGE 2 – INTENSIVE SKILL DEVELOPMENT

- Week 3: Order Flow Training

- Learn to analyze and interpret live data streams to predict market movements.

- Practical sessions on using order flow as a predictive tool for trading.

- Week 4: Profile Pattern Recognition and Execution

- Mastering the identification and exploitation of pattern-based trading opportunities.

- Simulation exercises to practice pattern recognition and execution.

- Week 5: Macro and Geopolitical Strategies Training

- Application of macroeconomic and geopolitical analysis in trading decisions.

- Case studies involving current events and their impact on the markets.

STAGE 3 – IMMERSIVE TRADING FLOOR DEVELOPMENT

- Week 6: Elite Edge Development

- Enhancing trading strategies with advanced analytical techniques.

- Real-time trading exercises to develop a competitive edge.

- Week 7: Elite Trader Routine

- Establishing a disciplined and effective daily trading routine.

- Workshops on mental and psychological aspects of trading.

- Week 8: Elite Market Pattern Development

- Advanced training on recognizing and leveraging complex market patterns.

- Capstone projects to apply all learned skills in a simulated environment.

4️⃣. Who is Axia Futures?

Axia Futures is a leader in trading education, rooted deeply in the rich history of the financial markets. Founded on the principles of excellence and commitment to trader development, Axia Futures has established itself as a premier institution offering cutting-edge trading courses. The firm is part of the Axia Trading Group, a collaboration with Axia Markets Pro, which is regulated by the FCA and boasts a legacy dating back to the CME and LCH trading pits of 1984.

Axia Futures is headquartered in London, UK, with significant operations in Wrocław, Poland, and Limassol, Cyprus. The organization prides itself on its core team of elite traders who not only actively engage in the markets but also dedicate themselves to mentoring the next generation of traders. The training facilities in Wrocław are part of this comprehensive educational endeavor, providing an immersive learning environment that integrates live streaming sessions from London with hands-on experience on the trading floor.Co-founder Alex Haywood, a recognized figure in the futures market, frequently shares his expertise on platforms like Bloomberg, discussing strategies and market insights. Under his leadership, Axia Futures emphasizes a hybrid training model that combines cognitive development techniques with practical, market-driven strategies to maximize the learning impact and trader performance.

5️⃣. Who should take this course?

- Aspiring Traders: Individuals looking to start a career in futures trading with no prior experience.

- Skilled Practitioners: Experienced traders aiming to enhance their market analysis and trading execution strategies.

- Financial Professionals: Analysts, brokers, and other financial professionals who want to diversify their skills in futures markets.

- International Students: Those who are looking to study in a dynamic, live trading environment while gaining exposure to global trading strategies.

- Career Changers: Professionals seeking to transition to trading from other fields, leveraging intensive, skill-focused training.

This course is designed for anyone who aspires to become a professional trader, providing the tools, knowledge, and practical experience necessary to succeed in the high-stakes world of futures trading.

6️⃣. Frequently Asked Questions:

Q1: How do I become a futures trader?

This often involves pursuing relevant education, such as finance or economics, and gaining hands-on experience through trading simulations or educational programs like the Axia Futures Career Programme. Practical experience, particularly in a live trading environment, is invaluable. There are no formal qualifications required to start trading, but a comprehensive training program can significantly enhance your skills and market understanding.

Q2: What skills do you need to be a trader?

Successful traders often possess a mix of analytical skills, discipline, and risk management abilities. Key skills include:

– Analytical Skills: Ability to interpret market data and make quick decisions.

– Mathematical Skills: Understanding of probability, risk assessment, and financial analysis.

– Emotional Discipline: Ability to maintain composure under pressure and adhere to a trading plan without letting emotions drive decisions.

– Adaptability: Being able to adjust strategies as the market changes.

Q3: Can I trade futures with $100?

Yes, it is possible to start trading futures with as little as $100 with the advent of micro-futures contracts. These contracts are smaller in size and require less capital, making them accessible for beginners looking to enter the market without significant risk.

Q4: Can you make a living off trading futures?

Yes, many individuals make a living trading futures. However, it requires a deep understanding of the markets, robust strategies, and effective risk management. Trading can be highly volatile, and earning a consistent income requires discipline, continual learning, and experience.

Q5: What is the best way to learn futures trading?

The best way to learn futures trading is through a combination of theoretical education and practical experience. Consider enrolling in a specialized training program like the Axia Futures Career Programme, which provides immersive, real-world trading floor exposure and live streaming education. This hands-on approach helps to build the skills necessary to trade effectively and understand market dynamics thoroughly.

Be the first to review “Axia Futures – Wroclaw Career Programme” Cancel reply

Related products

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Anton Kreil – Professional Options Trading Masterclass (POTM)

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Reviews

There are no reviews yet.