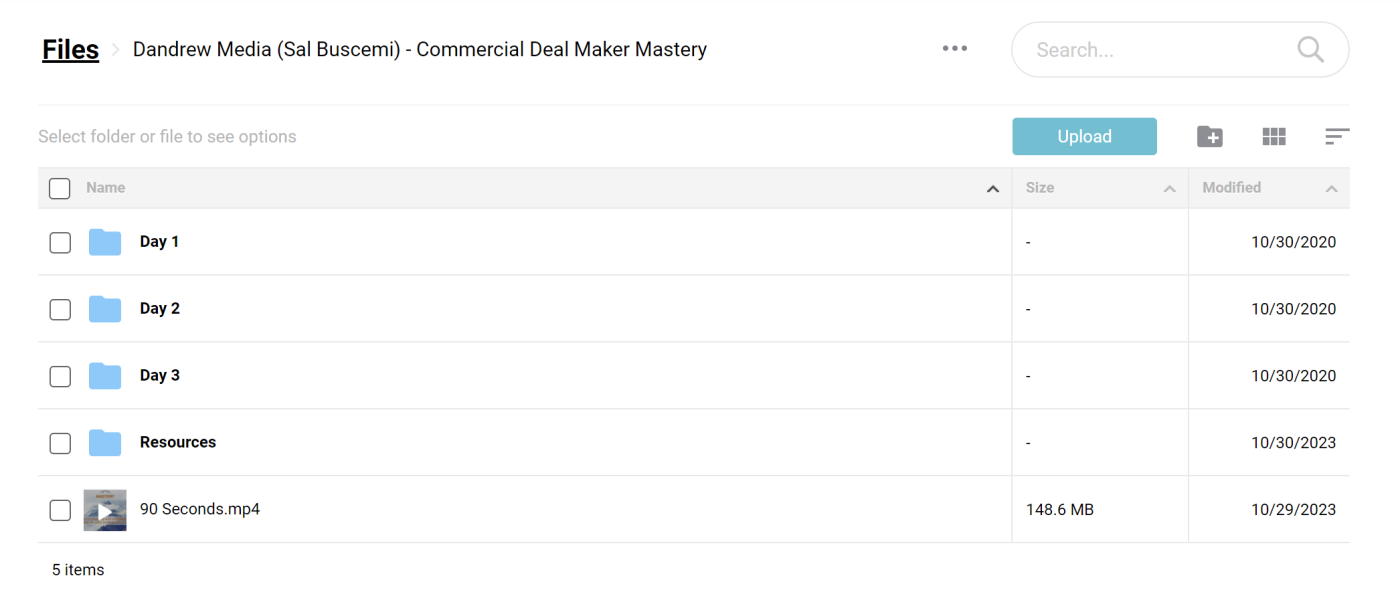

Dandrew Media (Sal Buscemi) – Commercial Deal Maker Mastery

$30.00

Dandrew Media (Sal Buscemi) Commercial Deal Maker Mastery Course [Download]

1️⃣. What is Commercial Deal Maker Mastery:

Dandrew Media’s Commercial Deal Maker Mastery is a comprehensive course designed to transform you into a skilled commercial deal maker. It equips you with the necessary tools and strategies to excel in the competitive world of real estate investment. This course covers everything from analyzing and structuring deals to raising capital and identifying profitable properties.

Through 3 days of live recorded training, previously attended by individuals who paid $5,800, you gain access to invaluable insights. This program not only teaches you the technical skills required but also delves into the practical aspects of building a successful commercial real estate business.

Whether you are starting out or looking to expand your existing portfolio, this course offers the guidance and expertise needed to navigate the complexities of commercial deals effectively. With Dandrew Media’s mastery program, step into the role of a confident and informed deal maker in today’s dynamic market.

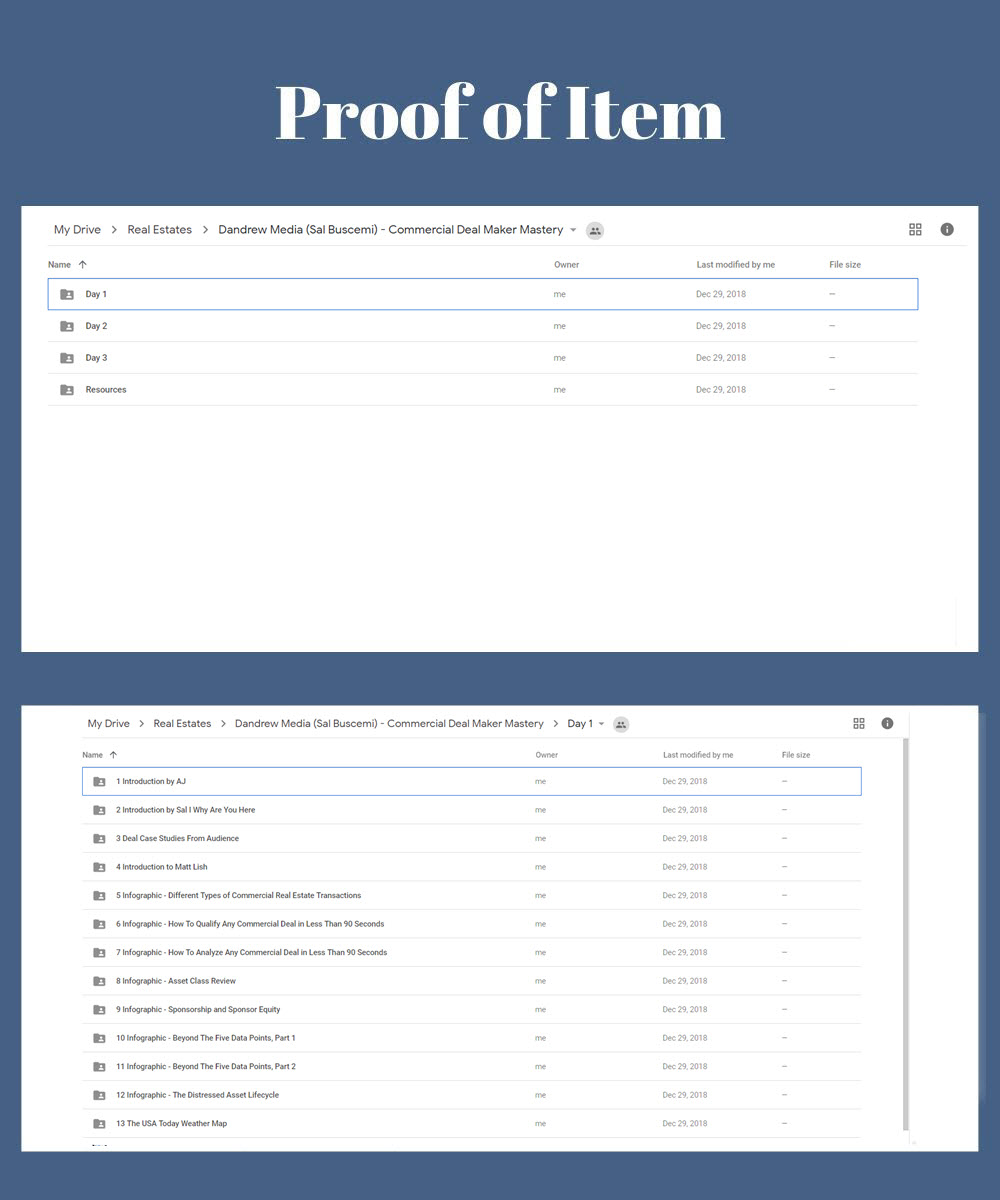

📚 PROOF OF COURSE

2️⃣. What you will learn in Commercial Deal Maker Mastery:

In this intensive course, you will gain the knowledge to:

- Qualify commercial deals quickly and efficiently, giving you an edge over 90% of investors.

- Understand the intricacies of different asset classes including Retail, Multifamily, Office, and Industrial.

- Navigate the sponsorship and equity requirements to ensure successful deal qualification.

- Master the assessment and valuation of properties across various scenarios, from REO to stressed capital structures.

- Learn strategies for buying non-performing commercial notes and mitigating risks.

- Avoid common pitfalls that cause commercial deals to fail.

- Craft the perfect pitch to secure capital and close high-stake deals.

3️⃣. Commercial Deal Maker Mastery Course Curriculum:

This high-level, exclusive training from Dandrew Media’s Commercial Deal Maker Mastery course equips you with everything required to excel as a deal maker, intermediary, and consultant. Over three days of live-recorded training, you’ll delve into a curriculum designed to enhance your skills in deal analysis, capital raising, and identifying lucrative properties.

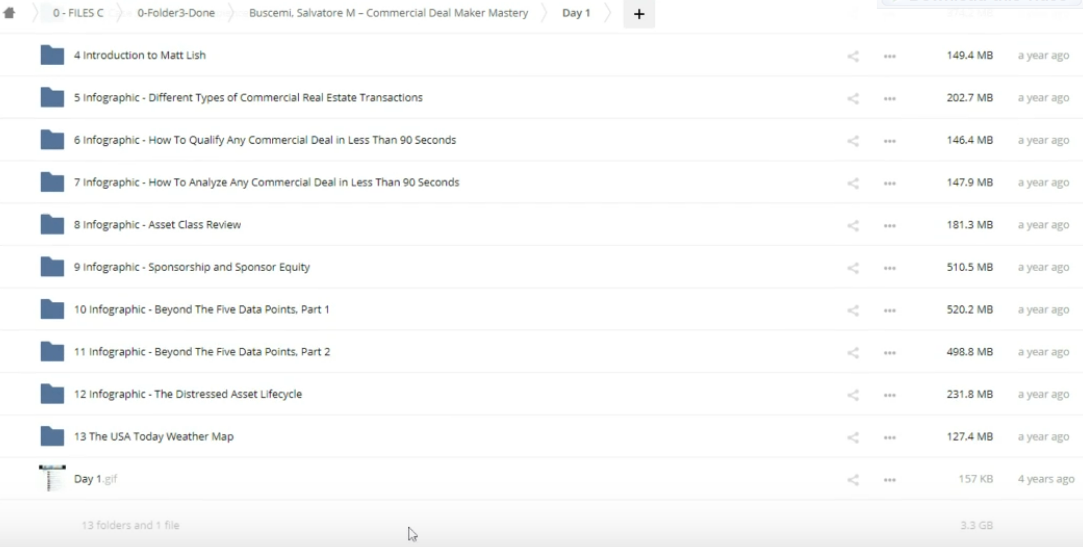

Day 1

- Introduction by AJ

- Introduction by Sal | Why Are You Here

- Deal Case Studies From Audience

- Introduction to Matt Lish

- Infographic – Different Types of Commercial Real Estate Transactions

- Infographic – How To Qualify Any Commercial Deal in Less Than 90 Seconds

- Infographic – How To Analyze Any Commercial Deal in Less Than 90 Seconds

- Infographic – Asset Class Review

- Infographic – Sponsorship and Sponsor Equity

- Infographic – Beyond The Five Data Points, Part 1

- Infographic – Beyond The Five Data Points, Part 2

- Infographic – The Distressed Asset Lifecycle

- The USA Today Weather Map.

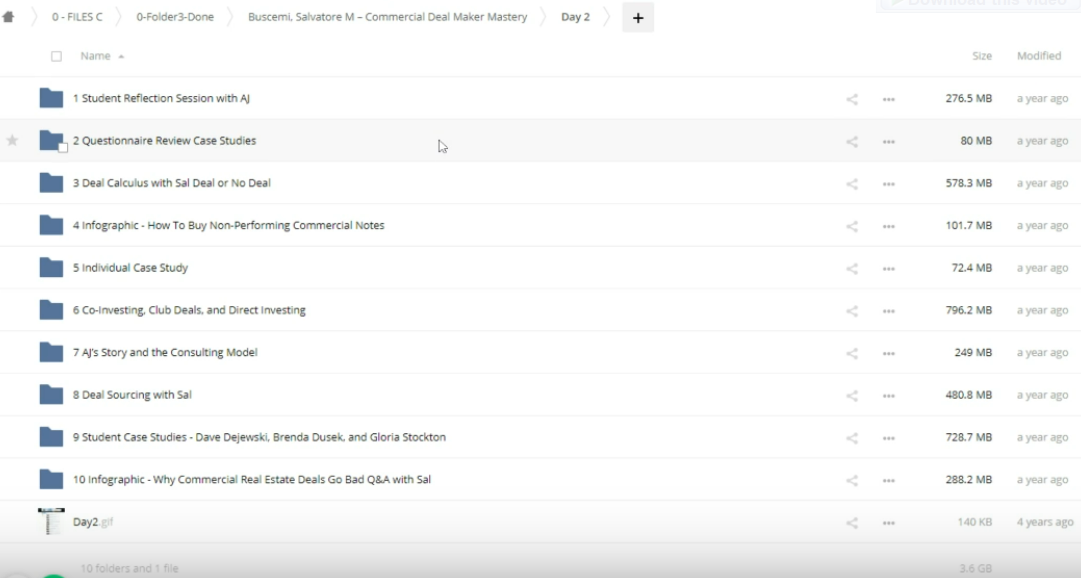

Day 2

- Student Reflection Session with AJ

- Questionnaire Review Case Studies

- Deal Calculus with Sal: Deal or No Deal

- Infographic – How To Buy Non-Performing Commercial Notes

- Individual Case Study

- Co-Investing, Club Deals, and Direct Investing

- AJ’s Story and the Consulting Model

- Deal Sourcing with Sal

- Student Case Studies – Dave Dejewski, Brenda Dusek, and Gloria Stockton

- Infographic – Why Commercial Real Estate Deals Go Bad Q&A with Sal

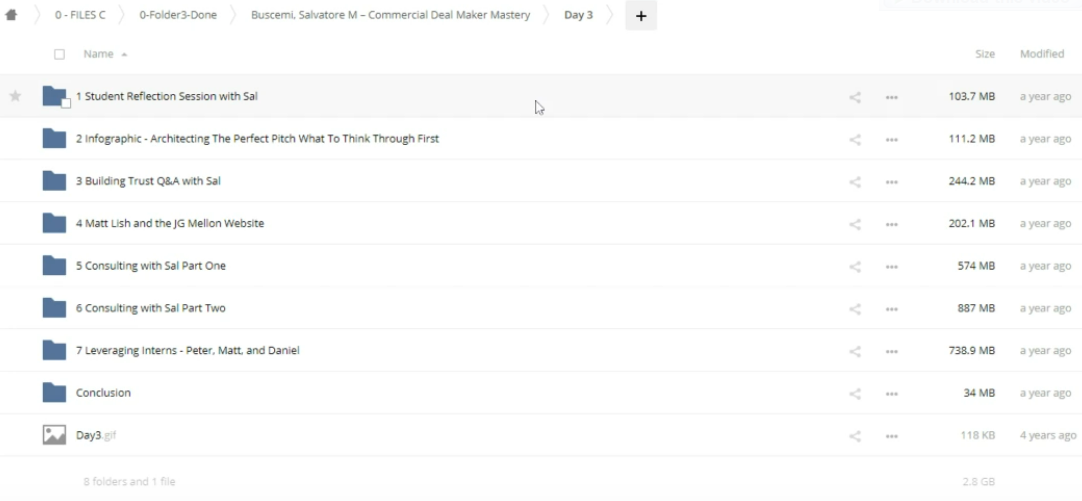

Day 3

- Student Reflection Session with Sal

- Infographic – Architecting The Perfect Pitch What To Think Through First

- Building Trust Q&A with Sal

- Matt Lish and the JG Mellon Website

- Consulting with Sal Part One

- Consulting with Sal Part Two

- Leveraging Interns – Peter, Matt, and Daniel

- Conclusion

Resources

The course also covers strategic topics like crafting the perfect pitch to secure investments, building a profitable consulting business, and innovative methods for co-investing and deal sourcing. With comprehensive resources like MP3s, infographics, and direct mentoring from Sal, you are set to become a top-tier commercial deal maker.

4️⃣. Who is Dandrew Media (Sal Buscemi)?

Dandrew Media, spearheaded by Sal Buscemi, stands as a beacon of expertise in the realm of commercial real estate investment. Sal Buscemi, a seasoned investor and educator, has carved a niche in high-stakes investment strategies, particularly in commercial real estate. His career began at Goldman Sachs in investment banking, which laid the foundation for his deep understanding of financial markets.

Sal’s trajectory in the finance sector is marked by his roles as CEO and Co-Founding Partner of HRN, LLC, and CEO of Dandrew Partners Capital Management. Under his leadership, these entities have thrived, handling multi-family investments, commercial real estate, and special situations funds. His insight is further demonstrated through his successful investments in high-profile companies like Airbnb and Lyft.

Beyond his corporate achievements, Sal is an acclaimed author, with publications that have set benchmarks in real estate investing. His books are sought after for their practical advice and in-depth analysis of fund management and real estate lending. A sought-after speaker, Sal’s insights are regularly featured in top financial publications and conferences, enhancing his reputation as a leading authority in real estate finance.

5️⃣. Who should take this course?

Commercial Deal Maker Mastery is tailored for a diverse audience looking to make significant strides in real estate investing:

- Aspiring Investors: Individuals new to real estate who seek a comprehensive foundation in commercial deal making.

- Seasoned Professionals: Experienced investors wanting to refine their skills and explore new, creative deal structures.

- Real Estate Consultants: Those aiming to enhance their consulting services and offer more value to their clients.

- Financial Strategists: Professionals in finance who need to understand real estate investments to better integrate them into broader investment strategies.

- Entrepreneurial Spirits: Visionaries who aspire to build and scale their own real estate investment or consulting business.

6️⃣. Frequently Asked Questions:

Q1: How to get started as a real estate investor?

To begin investing in real estate, start with educating yourself about the market and investment strategies. Consider enrolling in courses like Commercial Deal Maker Mastery to gain a solid understanding of deal structuring and capital raising. Networking with experienced investors and consulting with real estate professionals can also provide valuable insights.

Q2: Is real estate investing hard to get into?

Entering the real estate market can be challenging but is achievable with the right resources and knowledge. It requires understanding the local market conditions, financial strategies, and legal implications. Starting with smaller investments or partnering with experienced investors can ease the process.

Q3: How to invest in real estate when you’re poor?

Real estate investment can be accessible even with limited funds. Options include real estate investment trusts (REITs), partnering with other investors, or considering less expensive properties that can be renovated. Crowdfunding platforms also offer a way to invest small amounts in larger projects.

Q4: Is real estate good passive income?

Real estate can be a great source of passive income, especially through rental properties or REITs. Once you’ve established a property, it can provide a steady income stream with relatively minimal ongoing effort compared to other business ventures.

Q5: What is the fastest way to raise capital?

The fastest way to raise capital often involves reaching out to personal networks, angel investors, or using crowdfunding platforms. For real estate specifically, options include securing a home equity line of credit, finding venture capital through real estate-focused investors, or participating in joint ventures with other investors.

Be the first to review “Dandrew Media (Sal Buscemi) – Commercial Deal Maker Mastery” Cancel reply

Related products

Real Estate

Real Estate

Real Estate

Real Estate

Real Estate

Real Estate

Real Estate

Reviews

There are no reviews yet.