REIClub Foreclosure Academy

$30.00

REIClub Foreclosure Academy Course [Instant Download]

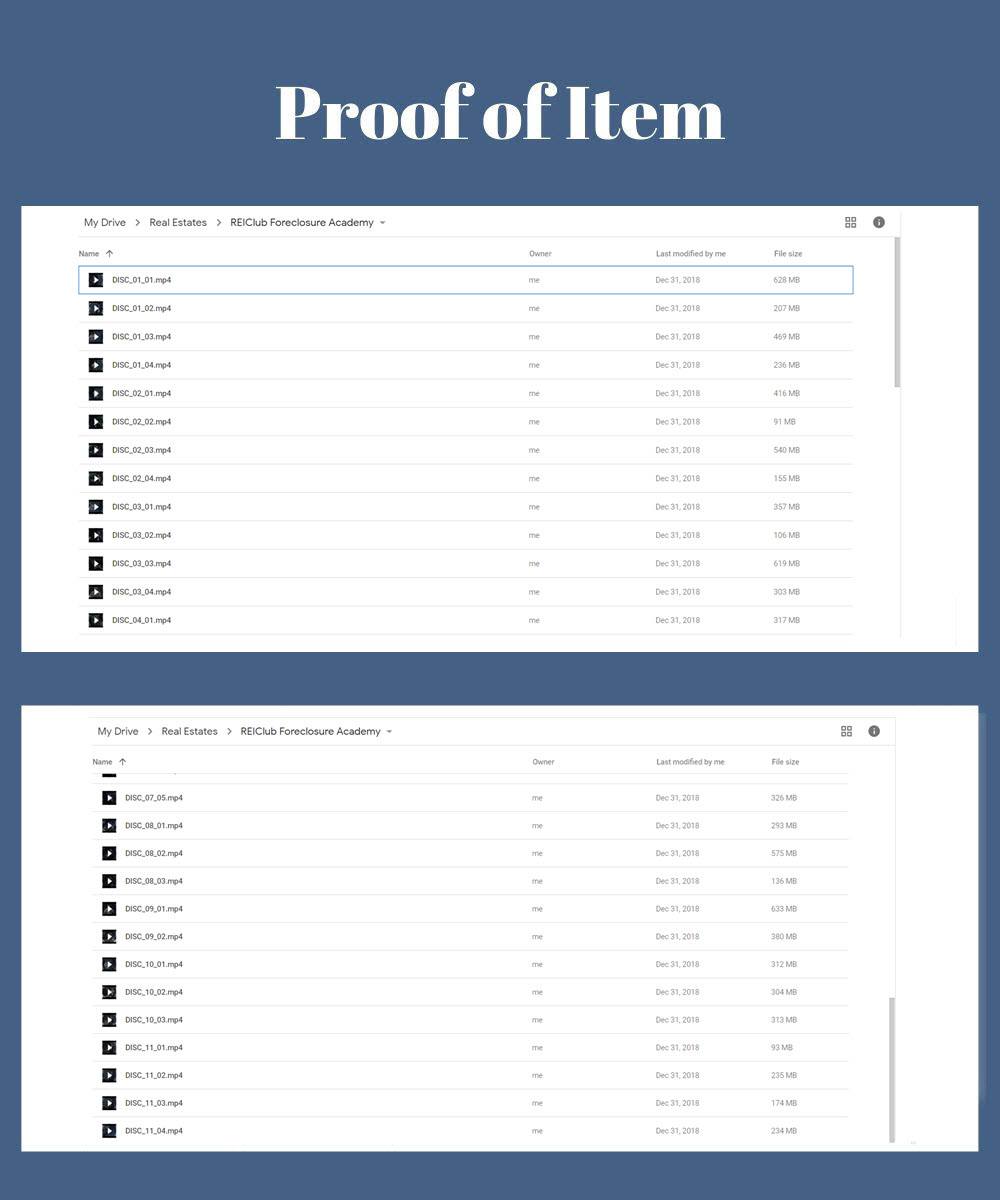

📚 PROOF OF COURSE

1️⃣. What is REIClub Foreclosure Academy:

The REIClub Foreclosure Academy offers a comprehensive online learning experience designed to equip you with the skills needed to excel in foreclosure investments. This course breaks down complex foreclosure processes into understandable strategies, utilizing real-life scenarios to illustrate key concepts.

By enrolling in the REIClub Foreclosure Academy, you gain access to expert knowledge and insider tips that have been cultivated since 2002. Whether you’re looking to navigate your first investment or aiming to expand your portfolio, this course provides the tools necessary for success. The curriculum is built around actual successful transactions, highlighting the nuances of negotiation and legal considerations to safeguard your investments.

Transform your understanding of the real estate market through this course and start capitalizing on opportunities that others might miss. This academy is not just about learning—it’s about applying this knowledge effectively to achieve financial freedom and stability.

2️⃣. What you will learn in Foreclosure Academy:

In the REIClub Foreclosure Academy, you will learn:

- Comprehensive Short Sale Procedures: Understand each layer of the short sale process from the initial contact with banks to closing deals smoothly and efficiently.

- Legal Framework and Documentation: Master the art of crafting foolproof offers with the necessary forms, disclosures, and clauses to minimize liability and enhance profitability.

- Negotiation Tactics: Gain insights from a former bank Loss Mitigator on how to negotiate deals that bring you maximum financial benefit.

- Property Analysis and BPOs: Learn how to conduct Broker Price Opinions effectively to determine the feasibility and profitability of transactions.

- Creative Financing Solutions: Discover innovative contract strategies and financing options that bypass traditional barriers to quick and profitable deal closure.

- Market Dynamics and Lead Generation: Equip yourself with knowledge of the latest marketing strategies and tools that can fill your pipeline with viable leads.

- Asset Protection and Legal Safeguards: Learn how to protect your investments with strategic legal tools and understand the essential records you must keep.

3️⃣. Foreclosure Academy Course Curriculum:

✅ SHORT SALE-ANOMICS (4 hours, 12 minutes)

- Effective Short Sale Packages: Learn the art of assembling short sale documents that lenders can’t refuse, including hardship letters and HUD1.

- HUD1 Optimization: Techniques for crafting HUD1 documents that maximize financial gains in every deal.

- Navigating Bank Preferences: Insights into bank behaviors and strategies to enhance success rates with various lenders.

- Broker Price Opinions (BPOs): Mastering BPOs to influence transaction outcomes favorably.

- Key Clauses in Short Sale Purchase Agreements: Understanding the critical legal clauses that protect your interests in a deal.

✅ CONTRACTS-A-GO-GO (4 hours, 55 minutes)

- Innovative Contracting Strategies: Exclusive access to unique and effective contracting methods that outperform traditional approaches.

- Navigating Complex Legal Landscapes: Strategies for handling Freddie Mac’s property flipping waivers and avoiding seasoning issues.

- Legally Structuring A-B, B-C Sales: Conduct same-day sales using FHA loans without legal pitfalls.

- Effective Collaboration with Title Companies: How to choose and work with title companies or closing attorneys that can make or break your deals.

- Strategic Offer Countering: Techniques for countering offers to always stay on top of negotiations.

- Importance of Notice of Option Contracts: Utilizing option contracts to secure transactions and protect your investments.

✅ MARKETING MACHINES (5 hours, 49 minutes)

- Collaborating with Realtors: Leveraging relationships with realtors to accelerate property listings and sales.

- Mastering Online Marketing: Dominating your market presence online through targeted strategies.

- Automated Lead Generation: Using blogging and Twitter to fill your sales pipeline effortlessly.

- Target Market Analysis: Identifying and understanding your ideal customer base to optimize marketing efforts.

- Referral Systems and Lead Monetization: Setting up referral engines to maximize lead potential and revenue from various channels.

✅ BUSINESS MULTIPLICATION (5 hours, 59 minutes)

- Investor vs. Business Owner Mindset: Differentiating roles to maximize profit and operational efficiency.

- Business Systematization: Implementing systems and processes that ensure business growth and sustainability.

- Strategies for Effective Outsourcing and Delegation: Mastering the art of outsourcing to enhance productivity and focus on high-value activities.

- Commission-based Compensation: Understanding its advantages and implementing it to motivate your team.

- Management of Negotiation Processes: Training and strategies for managing in-house negotiators to handle multiple transactions efficiently.

✅ ASSET PROTECTION (47 minutes)

- Legal and Financial Challenges: Identifying and overcoming the top legal and financial hurdles that real estate investors face.

- Record-Keeping Fundamentals: The critical importance of maintaining accurate and thorough documentation.

- Implementing Wealth Shields: Strategies for using legal protections to safeguard your assets effectively.

- Managing Multiple Identities: The strategic use of multiple identities in business to minimize risks and protect wealth.

- Mitigating Visibility Risks: Understanding how high visibility can threaten your financial security and how to combat it.

4️⃣. Who is REIClub?

REIClub is a pivotal resource for real estate investors across the spectrum, from novices to seasoned professionals. Founded in 2002, REIClub has grown to become a trusted community hub where over 200,000 users converge to share knowledge, resources, and opportunities.

At the heart of REIClub’s philosophy is a commitment to practical education and support. The founder, leveraging personal experiences of navigating through real estate’s ups and downs—foreclosure, bankruptcy, and market shifts—has shaped a platform that not only teaches but also mentors its members through every step of their investment journey.

The REIClub Foreclosure Academy, one of its flagship offerings, embodies this ethos by providing detailed, action-oriented learning tailored to the realities of the foreclosure market. With a focus on ethical investment strategies and community building, REIClub not only instructs but also instills a sense of responsibility and integrity in its members, ensuring they are well-prepared to make positive impacts in the real estate world.

5️⃣. Who should take this course?

- Aspiring Investors: If you’re looking to start your journey in real estate investment, this course lays down the foundational knowledge and practical skills you need.

- Experienced Real Estate Professionals: Enhance your understanding of foreclosure processes and discover advanced strategies to increase your profitability.

- Real Estate Brokers and Agents: Gain insights into foreclosure investments to better serve your clients and expand your service offerings.

- Financial Advisors and Legal Practitioners: Understand the intricacies of foreclosure investments to provide informed advice to your clients navigating these challenges.

The REIClub Foreclosure Academy is designed for individuals who are serious about leveraging real estate for wealth building and seeking comprehensive, expert-led training in foreclosure investment strategies.

6️⃣. Frequently Asked Questions:

Q1: What is the best site to find foreclosed homes?

Some of the best websites to find foreclosed homes include RealtyTrac, Zillow (which marks properties as “Foreclosed” or “Pre-Foreclosure”), and Auction.com. Additionally, the official HUD site and local real estate agents’ websites can provide listings for government-owned properties.

Q2: What is the definition of a foreclosure?

A foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments to the lender by forcing the sale of the asset used as the collateral for the loan. This typically pertains to a residential property.

Q3: What makes distressed properties a valuable niche for investors?

Distressed properties attract investors due to their lower-than-market prices, which can lead to high returns after renovations. This niche offers the opportunity for significant property value improvements and the potential for quick resales or profitable rentals.

Q4: How do distressed investors make money?

Distressed investors typically profit by purchasing properties at a significant discount, resolving any legal and financial issues, renovating them, and then selling them at a higher market price or renting them out at competitive rates for a steady income stream.

Q5: What are the pitfalls of a short sale?

Short sales can be complex and time-consuming, often requiring lengthy negotiations with multiple stakeholders. Potential pitfalls include bank rejections of the sale price, unforeseen legal issues, and the property’s condition being worse than expected, which could increase the overall investment needed to rehabilitate the home.

Be the first to review “REIClub Foreclosure Academy” Cancel reply

Related products

Real Estate

Real Estate

Real Estate

Real Estate

Real Estate

Real Estate

Real Estate

Real Estate

Reviews

There are no reviews yet.