TradingwithRayner – Price Action Trading Institute

$1,970.00 Original price was: $1,970.00.$158.65Current price is: $158.65.

TradingwithRayner Price Action Trading Institute Course [Instant Download]

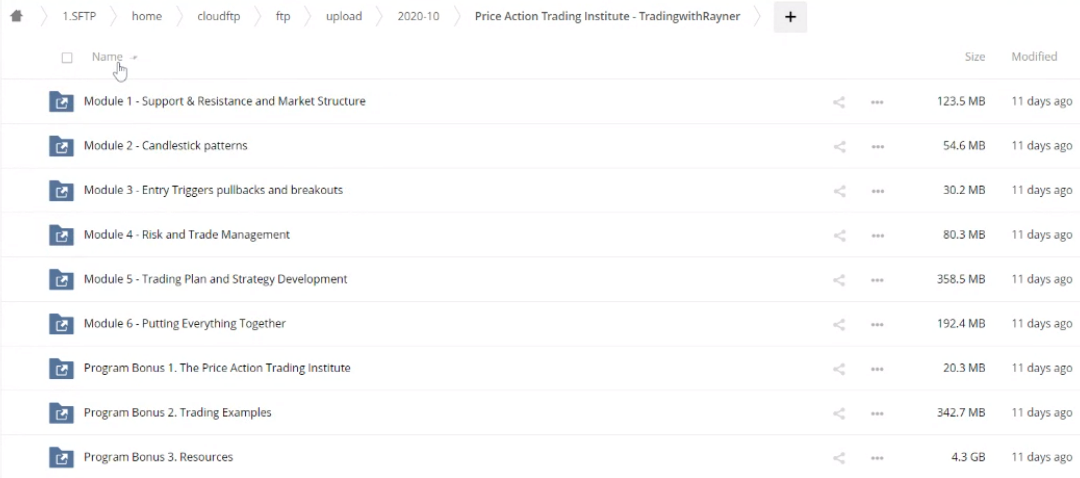

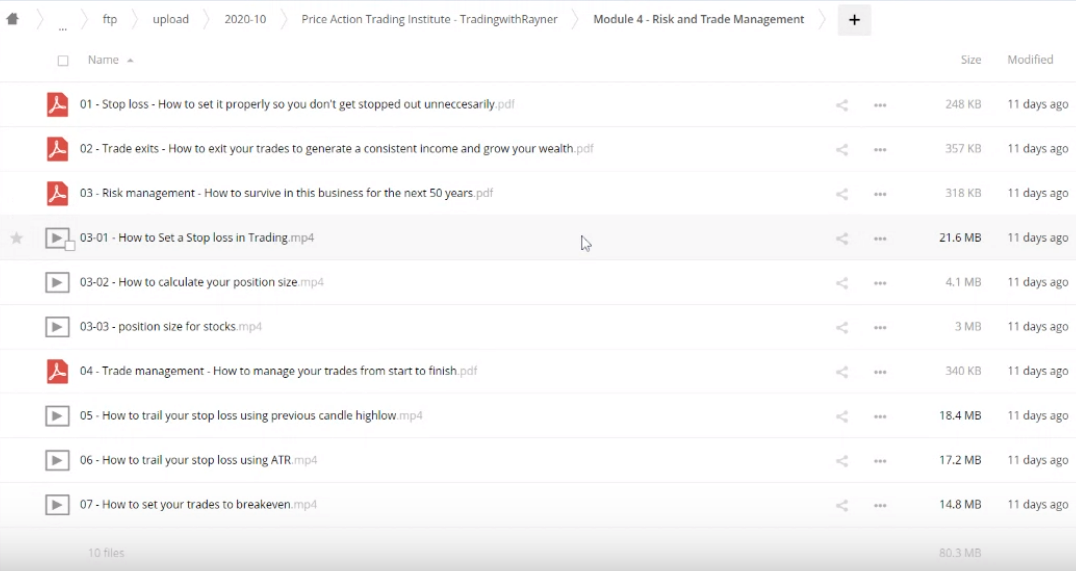

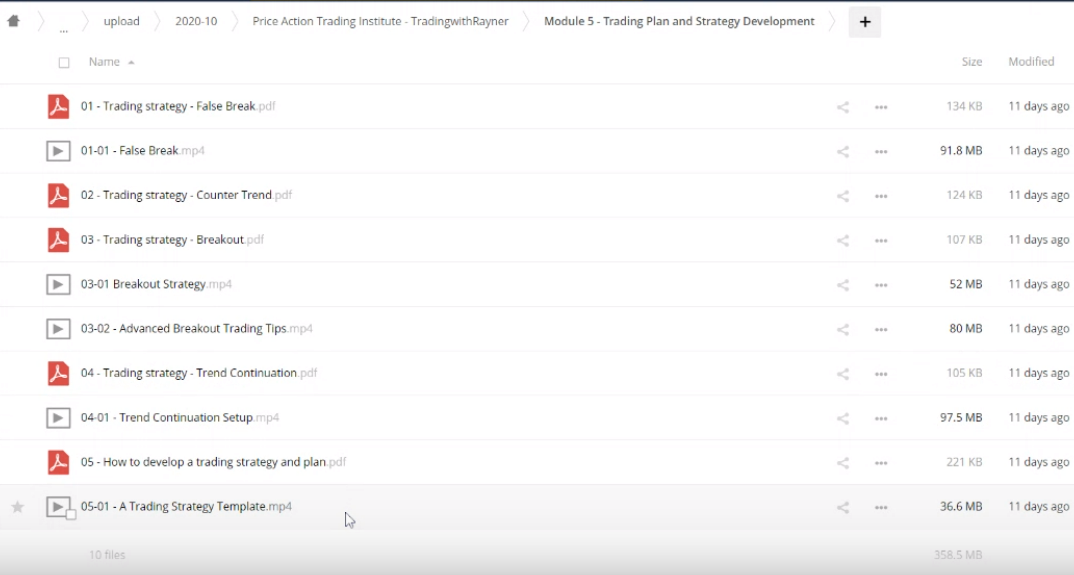

📚 PROOF OF COURSE

1️⃣. What is Price Action Trading Institute:

The Price Action Trading Institute offers a robust course designed to equip traders with the necessary skills to achieve consistent profitability in the trading world. Rayner Teo, a renowned independent trader and the founder of TradingwithRayner, demystifies the complexities of market dynamics using simple, straightforward methodologies. This course specifically targets the practical application of price action techniques to predict market movements and manage trades effectively.

Structured around real-world applicability rather than theoretical concepts, the course introduces participants to unique entry triggers and strategies that work across different markets and timeframes. Rayner’s approach is grounded in the principle of hard work and perseverance, preparing traders to operate with precision and discipline, which are crucial for success in trading.

2️⃣. What you will learn in Price Action Trading Institute:

Participants of the Price Action Trading Institute will gain insights into various strategic aspects of trading including:

- Understanding the Misconceptions: Learn why traditional stop loss placements below Support or above Resistance might not always be effective and what alternative strategies you can employ.

- Proprietary Entry Triggers: Rayner introduces four unique entry triggers that minimize risks and enhance the potential for profitable trades.

- Market Prediction Techniques: Acquire skills to predict market turning points with exceptional accuracy through simple yet powerful line drawing techniques.

- Universal Trading Strategies: Discover how the taught strategies can be applied in any market condition, whether it be bull or bear, and across various timeframes, ensuring versatility in your trading approach.

- Beyond the Basics: The course not only covers the fundamentals but also delves into deeper insights that will aid in sustaining profitability over the long term.

3️⃣. Price Action Trading Institute Course Curriculum:

- Module 1: Support & Resistance and Market Structure

- Module 2: Candlestick patterns

- Module 3: Entry Triggers pullbacks and breakouts

- Module 4: Risk and Trade Management

- Module 5: Trading Plan and Strategy Development

- Module 6: Putting Everything Together

- Program Bonus 1: The Price Action Trading Institute

- Program Bonus 2: Trading Examples

- Program Bonus 3: Resources

4️⃣. Who is Rayner Teo?

Rayner Teo is not your typical financial guru. As the founder of TradingwithRayner and an independent trader, Rayner stands out as the most-followed trader in Singapore, with a substantial global reach influencing over 200,000 traders monthly through his blog. His journey in the trading world began not with an influx of wealth, but with a commitment to understanding and simplifying the complexities of trading for himself and his followers.

His expertise is not derived from financial theories but from real-world experiences and a pragmatic application of research done by those more qualified. This unique approach has not only made him relatable but also immensely successful in teaching others how to achieve consistent profitability without the allure of get-rich-quick schemes. Rayner’s educational background and professional tenure as a prop trader provided him with the foundational skills necessary to mentor aspiring traders effectively.

Through his course, the Price Action Trading Institute, Rayner aims to impart practical strategies that are both simple to understand and implement. His dedication to honesty and transparency is evident in his teaching style, where he openly shares the realities of trading — including the challenges one might face and the hard work required to overcome them.

5️⃣. Who should take this course?

Who is this course for?

- Aspiring Traders: Individuals looking to start their trading journey with a solid foundation in price action strategies.

- Experienced Traders: Seasoned traders who want to refine their skills and learn new, proprietary techniques for better market prediction and entry execution.

- Skeptics of Conventional Methods: Those who have found traditional trading advice unhelpful or inadequate and are looking for actionable, realistic strategies to improve their trading outcomes.

Key Benefits:

- Practical Knowledge: The course cuts through the theoretical clutter to provide practical strategies that can be applied immediately.

- Disciplined Trading: Learn to trade with discipline, a crucial trait for success in the volatile trading market.

- Comprehensive Content: From basic concepts to advanced strategies, the curriculum is designed to cater to both beginners and experienced traders.

This course is ideal for anyone who is serious about trading and is ready to invest the effort required to master the art of price action trading.

6️⃣. Frequently Asked Questions:

Q1: What is a proprietary trading strategy?

A proprietary trading strategy involves techniques used by traders to use the firm’s money to realize profits from the markets. These strategies are diverse, including swing trading, arbitrage, options, and futures, focusing on maximizing short-term profit.

Q2: What are the 4 types of trading strategies?

The four primary types of trading strategies are:

– Day Trading: Buying and selling securities within the same trading day.

– Swing Trading: Trades that last from a day to several weeks to capitalize on expected upward or downward market shifts.

– Position Trading: Holding trades for several weeks, months, or even years to benefit from expected long-term trends.

– Scalping: Making numerous trades in a day to profit from small market movements.

Q3: How stressful is prop trading?

Prop trading can be highly stressful due to the significant risks involved and the high expectations to generate profits regularly. The stress levels can vary widely depending on market conditions, the trading strategy employed, and the individual’s risk tolerance.

Q4: What is the most profitable trading strategy?

The most profitable trading strategy varies by trader because it depends on their skills, risk tolerance, and market understanding. However, strategies like trend following, price action trading, and swing trading are commonly regarded as highly effective for consistent profitability.

Q5: Why do 90% of traders fail?

A significant reason why 90% of traders fail is due to a lack of discipline, inadequate risk management, and poor trading strategies. Many underestimate the psychological aspects of trading and the necessity for thorough research and continuous learning.

Be the first to review “TradingwithRayner – Price Action Trading Institute” Cancel reply

Related products

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Reviews

There are no reviews yet.