Optionpit – Volatility Master Class

$997.00 Original price was: $997.00.$185.00Current price is: $185.00.

Optionpit Volatility Master Class Course [Instant Download]

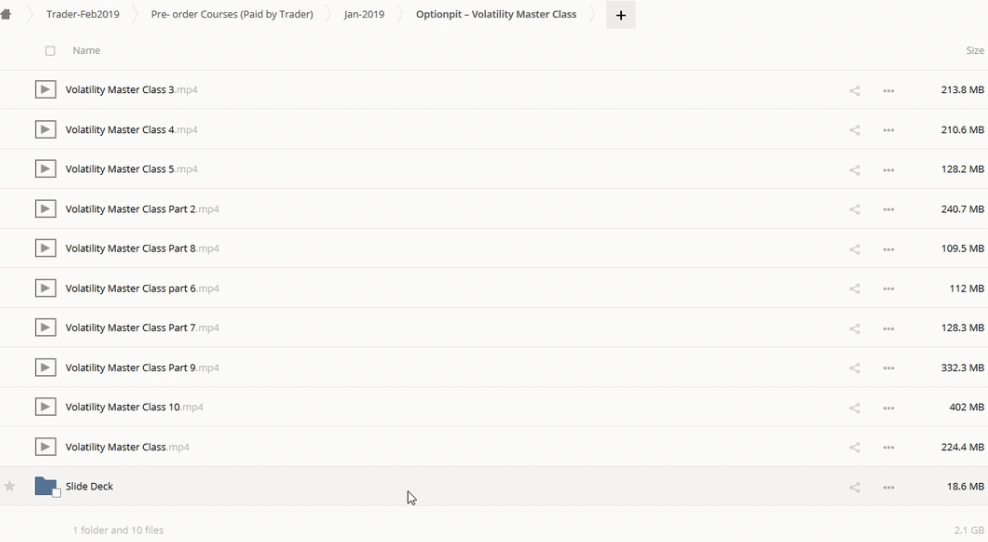

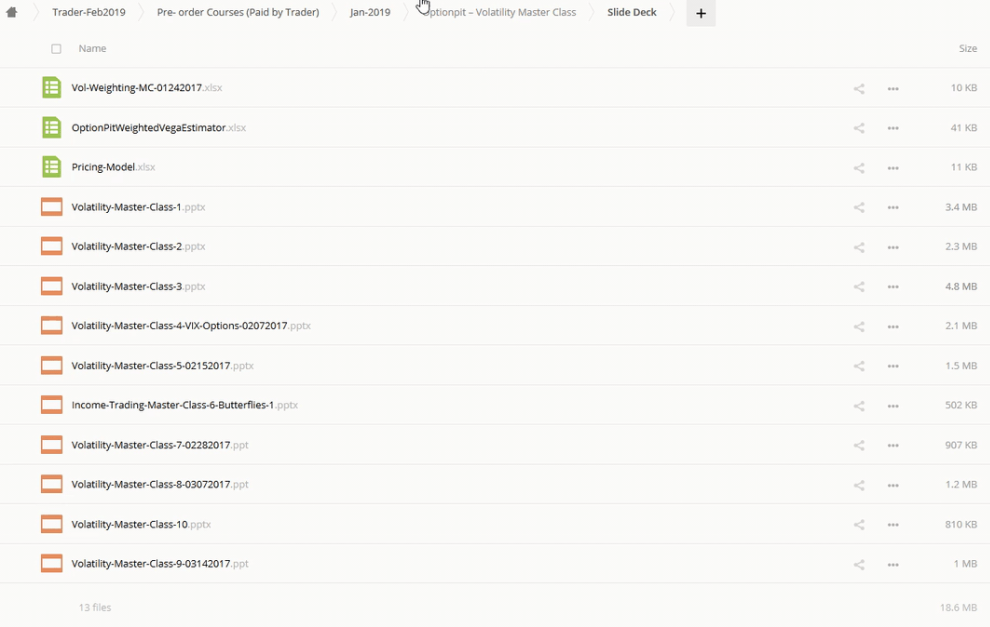

📚 PROOF OF COURSE

1️⃣. What is Optionpit’s Volatility Master Class:

The Optionpit’s Volatility Master Class is designed to empower traders with a profound understanding of market volatility. This course, led by industry veterans Mark Sebastian and Andrew Giovinazzi, provides comprehensive insights into volatility trading as a unique asset class. Participants will delve into the mechanics of trading VIX, VXXX, and SPX Index implied volatilities, learning to navigate through various market conditions with confidence.

By focusing on practical strategies and real-world applications, the course demystifies the complexities of the VIX and related vol products. It offers actionable tools that enable traders to manage gamma effectively, creating positions that benefit from both positive decay and long gamma scenarios. Whether you’re looking to refine your trading techniques or build on existing knowledge, this master class equips you with the skills to capitalize on volatility trends and optimize your trading outcomes.

2️⃣. What you will learn in Volatility Master Class:

In the Volatility Master Class, you will gain mastery over several key areas critical to successful volatility trading. Here’s what you can expect to learn:

- Understanding Realized Volatility: Learn how to accurately price realized volatility and build profitable trading strategies around it.

- Optimizing Options for Volatility Trades: Master the selection of expiration dates and strike prices to optimize your exposure to changes in volatility and time, enhancing Vega sensitivity.

- Maximizing Returns with Theta Positive Trades: Utilize volatility products to create positions that benefit from VIX future erosion while maintaining a positive Theta.

- Deep Dive into VIX and VIX Futures: Acquire a thorough understanding of the VIX future term structure and its market implications.

- Strategies for VIX Futures Contango and Backwardation: Learn to create optimized trades based on the relative levels of VIX cash and futures.

- Effective Use of Volatility ETPs: Understand how to trade volatility exchange-traded products (ETPs) effectively, beyond conventional wisdom.

- Pair Trading with SPY and Vol Products: Develop skills to create dynamic pair trading strategies that use VIX, vol products, and SPY for portfolio hedging.

Each module is designed to provide you with the practical skills and knowledge to enhance your trading efficacy and manage risks more effectively.

3️⃣. Volatility Master Class Course Curriculum:

In this 10 session class Mark Sebastian, Founder of Option Pit, and Andrew Giovinazzi, C.O.O. of Option Pit, teach traders:

- Learning to Price Realized Volatility: Understand the fundamentals of realized volatility and develop strategies to construct profitable trades around it.

- Optimizing Option Terms for Volatility Trades: Learn how to select optimal expiration dates and strike prices, and master the use of Vega to maximize your trade’s sensitivity to volatility changes.

- Maximizing Time Premium for Theta Positive Trades: Discover how to use volatility products to create positions that enjoy positive Theta, benefiting from VIX future erosion.

- Understanding the VIX and VIX Futures: Delve into the nuances of the VIX futures term structure and interpret what it signals about the market dynamics.

- VIX Futures Contango and Backwardation: Learn to craft optimized trades by leveraging the relationship between VIX futures and VIX cash levels.

- Trade Selection Based on VIX Zone: Enhance your trading decisions by quantifying volatility zones, optimizing position selection across all market conditions.

- Utilizing VIX Options at Opportune Times: Gain insights into the strategic use of VIX options for both short-term weekly and mid-term trades.

- Trading VXX, UVXY, XIV, and SVXY Options: Learn to exploit volatility products as they are designed, moving beyond conventional trading wisdom for better efficiency and risk-reward outcomes.

- SPY and Vol Product Pair Trading: Develop self-financing hedging techniques using VIX, vol products, and SPY to create trades that are long gamma but short volatility.

- Dynamic Pair Trading Strategies: Implement advanced pair trading strategies that use SPY and volatility instruments for balanced and effective market plays.

This comprehensive curriculum is designed to provide traders with the skills and knowledge necessary to navigate and profit from the complexities of volatility trading effectively.

4️⃣. Who is Optionpit?

Optionpit is a recognized leader in options education and trading resources, founded by Mark Sebastian, a former member of both the Chicago Board Options Exchange and the American Stock Exchange. Sebastian is well-known in the trading community for his deep understanding of market volatility and his ability to translate complex trading scenarios into actionable knowledge. He has authored the popular trading manual “The Option Trader’s Hedge Fund” and is a frequent guest on major financial networks such as CNBC, Fox Business News, and Bloomberg. His insights have been featured across national media outlets including Yahoo Finance, the Wall Street Journal, and Reuters.

Andrew Giovinazzi, the Chief Operating Officer of Optionpit, brings his own formidable experience to the team. He began his career on the trading floors of the Pacific Exchange and the Chicago Board Options Exchange, where he made markets in equity and index option classes. Later, he played a pivotal role at Group One, ltd in Chicago, where he managed and developed trading strategies. His career is distinguished by his innovative approach to options trading education and mentoring, focusing on practical and strategic applications of volatility trading.

Together, Sebastian and Giovinazzi have cultivated a suite of educational offerings at Optionpit, designed to equip both novice and experienced traders with the tools to excel in the ever-evolving options market. Their courses emphasize real-world applications and are praised for their clear, insightful delivery.

5️⃣. Who should take this course?

The Volatility Master Class by Optionpit is ideal for:

- Aspiring Traders: Individuals looking to enter the trading field with a solid foundation in volatility and options trading.

- Experienced Traders: Seasoned professionals seeking to deepen their understanding of volatility dynamics and enhance their trading strategies.

- Financial Professionals: Analysts, brokers, and other financial services professionals who need to understand market volatility for better risk management and investment strategies.

- Investment Enthusiasts: Anyone with an interest in the stock market who wants to learn more about the underpinnings of market movements and trading.

Participants can expect to gain not just theoretical knowledge but also practical skills that are directly applicable to real-world trading scenarios, making this course a valuable investment in their financial education.

6️⃣. Frequently Asked Questions:

Q1: What is volatility in simple terms?

Volatility refers to the rate at which the price of a security increases or decreases for a given set of returns. High volatility means that a security’s price can change dramatically over a short period in either direction. In the context of the stock market, it’s often associated with big swings in share prices.

Q2: How to handle market volatility?

Handling market volatility involves several strategies such as diversifying your investment portfolio, maintaining a long-term perspective, and avoiding the temptation to make impulsive decisions based on short-term market movements. Using stop-loss orders and setting up contingency plans can also help manage risk effectively.

Q3: Is market volatility good or bad?

Market volatility is not inherently good or bad but is a natural part of stock market behavior. For traders, high volatility can present opportunities for significant profits, particularly for those who trade short term. However, it also increases risks and potential for losses, so it requires careful strategy and risk management.

Q4: How do you trade the VIX index?

Trading the VIX involves using strategies based on predictions of market volatility. VIX, or the Volatility Index, measures the market’s expectation of volatility implied by S&P 500 index options. Traders can use VIX futures and options to speculate on or hedge against volatility. Understanding the VIX term structure is crucial for successful trading.

Q5: What reduces volatility?

Several factors can reduce market volatility, including strong economic indicators, clear and stable political environments, and central bank policies that promote market stability. Additionally, increased market liquidity and informed, rational trading behaviors by a large number of investors can also help dampen volatility.

Be the first to review “Optionpit – Volatility Master Class” Cancel reply

Related products

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Dan Sheridan – Butterflies for Monthly Income 2016 + Iron Condor Methodologies Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Elliott Wave Ultimate (A Must Have Blueprint For Professional Trading Success)

Stock Forex Options - Trading

Reviews

There are no reviews yet.