MarketCalls.in – Tradezilla 2.0

$68.00

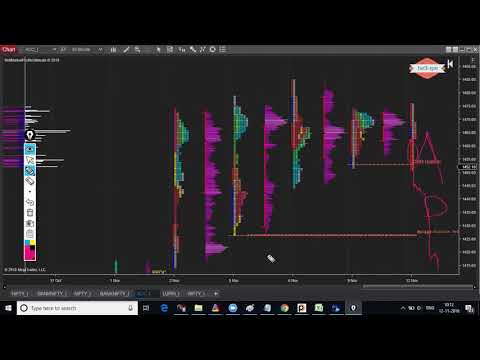

This Mentorship program solely focuses on Market Profile and Orderflow tools using Ninjatrader 8 software to make the traders help understand the objective way of look into short-term and intraday trading opportunities.

File size: 12.49GB

MarketCalls.in – Tradezilla 2.0

-

This Mentorship program solely focuses on Market Profile and Orderflow tools using Ninjatrader 8 software to make the traders help understand the objective way of look into short-term and intraday trading opportunities.

-

-

The course is designed in such a way that even traders who are new to technical analysis can understand as the course starts from the scratch of market profile and order-flow concepts.

-

-

Market Profile Basic

-

-

Introduction to Auction Process and Auction Market theory

-

Introduction to Market Profile / Volume Profile

-

Basic Building Blocks of Market Profile (TPOs, Initial Balance, Value Area, Point of Control, Tails, Range Extension)

-

Importance of Balance and Excess

-

Importance of Point of Control and Value Area

-

Market Profile Structure and Profile Distribution types

-

Importance of single prints

-

Understanding poor Structures, Poor Lows/Poor High, Weaker Low, Weaker High

-

Importance of Anomalies and Emotional profile structure

-

Importance of 45 degree line

-

Importance of Failed Auction

-

Importance of Spikes and Gaps

-

Understanding the behavior of Market Participants

-

Market Opening confidence Types

-

Importance of One timeframing and the underlying market confidence

-

-

Market Profile Intermediate

-

-

Multi-timeframe Top Down Analysis (barcharts)

-

Multi-timeframe volume profile analysis

-

How to understand Market Confidence for routine day trading or positional trading

-

Market Profile Key Reference levels (Intraday & short-term)

-

Introduction to Trading Inventory

-

Where trading money keep their stop-loss

-

Identify Strong Auction Process and Weaker Auction Process

-

Signature G2/G3 Patterns, R-PPOC levels, AB Poor lows

-

Look above the balance and fail, Look above the balance and accelerate

-

How to prepare for a trading day(Top Down analysis, Pre Market Analysis)

-

Checklist for Day Trading preparation, Key levels to monitor)

-

Initiative Vs Responsive Auctions

-

How to spot acceptance/rejection at key reference levels.

-

-

Market Profile Advanced

-

-

30+ Intraday Trading Techniques

-

Market Profile Positional Trading techniques

-

Top/Bottom Formation Setups

-

Short Covering/Long Liquidation Patterns

-

How to think from Exponential odds

-

How to manage risk while taking a view using market profile

-

Live Case Studies on Nifty/Bank Nifty and Top Nifty scrips

-

-

Ninjatrader 8 and Market Profile Settings

-

-

Understanding Ninjatader 8 and Datafeeds

-

Understanding Ninjatrader 8 settings

-

How to setups charts and optimal TPO size

-

Bell Market Profile Pro and Bell Market Profile Ultimate Settings

-

How to use Bell Market Profile Ultimate Scanners

-

Learn to use Bell Dynamic Profile Settings

-

How to use Bell Trend Analyzer along with G2/G3 patterns

-

-

Orderflow Trading Strategies – Basic

-

-

Basic Building Blocks of Orderflow, Delta, Cumulative Delta

-

Different representation of Orderflow views and its importance

-

Features of Bell Orderflow Ultimate and Settings

-

Lesson 4 : The commitment of Traders and Contract Reversals Explained

-

Types of Data Vendors and their data formats

-

Difference between Level 1, Level 2, Level 3 and Tick by Tick Feed

-

How Orderflow is plotted using uptick/downtick or BidxAsk methods

-

Difference between Orderflow and Bookmap

-

Introduction to Market Depth 101

-

Difference between liquidity and volume

-

L: How high liquidity and low liquidity affects the markets

-

What to Interpret from High volume nodes and Low volume nodes

-

Institutional Execution strategies

-

Principles of Orderflow

-

Importance of Stacked Momentum Buyers

-

-

Orderflow Trading Strategies – Advanced

-

-

How Smart money positioning and Unwind their positions

-

How to spot stop-hunting / Where most traders keep their stoploss

-

How to Identify Initiative Drive and Absorption auctions

-

How to Identify Trend reversals for scalping using orderflow

-

How to Identify very short term support and resistance levels

-

How to Identify failed breakout trading strategies for Intraday trading

-

How to Identify trend breakout trading strategies for Intraday trading

-

Momentum Trading and Momentum Exhaustion Trading Patterns

-

How to combine momentum exhaustion with Delta Divergence

-

Spotting Cumulative Delta Divergence

-

How to Identify Trapped Buyers or Trapped Sellers from Orderflow

-

How to make use of Unfinished business concepts

-

How to interpret R-Delta and MR – Signals from Orderflow

-

Which timeframe to use in Orderflow for scalping/intraday trading

-

Trading notes and Best Orderflow trading practices

Get MarketCalls.in – Tradezilla 2.0 download immediately on AMZLibrary.com!

Be the first to review “MarketCalls.in – Tradezilla 2.0” Cancel reply

Related products

Business & Marketing

$62.00

Business & Marketing

$82.00

Business & Marketing

$297.00

Business & Marketing

Stewart Gandolf & Lonnie Hirsch – Healthcare Marketing Strategies

$52.00

Business & Marketing

Rodney Walker – Grant Writing That Gets Funded Training Program (Deluxe)

$142.00

Business & Marketing

$62.00

Business & Marketing

$52.00

Business & Marketing

$142.00

Reviews

There are no reviews yet.