Market Timer Swing Day Trading System

$795.00 Original price was: $795.00.$87.40Current price is: $87.40.

We’ve taken Market Timer algorithms and TOS studies to the next level. Years in development, this brand new system has been tested successfully in a real-time, real-money trade environment Format File: [4 ThinkorSwim Script.. File Size: 19.7 KB

Market Timer Swing / Day Trading System

This New All-In-One, Complete Swing and Day Trading System for the S&P500, DOW and the Nasdaq Exceeded Our Expectations. We Think It Will Do The Same For You

When we started testing this new system we were not anticipating that it would exceed our expectations, but it did – by a wide margin.

We’ve taken Market Timer algorithms and TOS studies to the next level. Years in development, this brand new system has been tested successfully in a real-time, real-money trade environment (some of the videos below show real-time trading decision making and results).

What’s included:

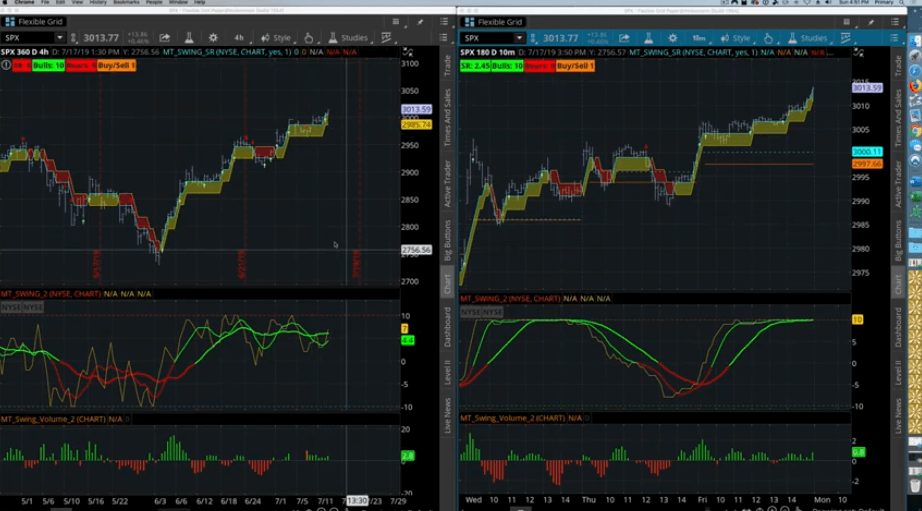

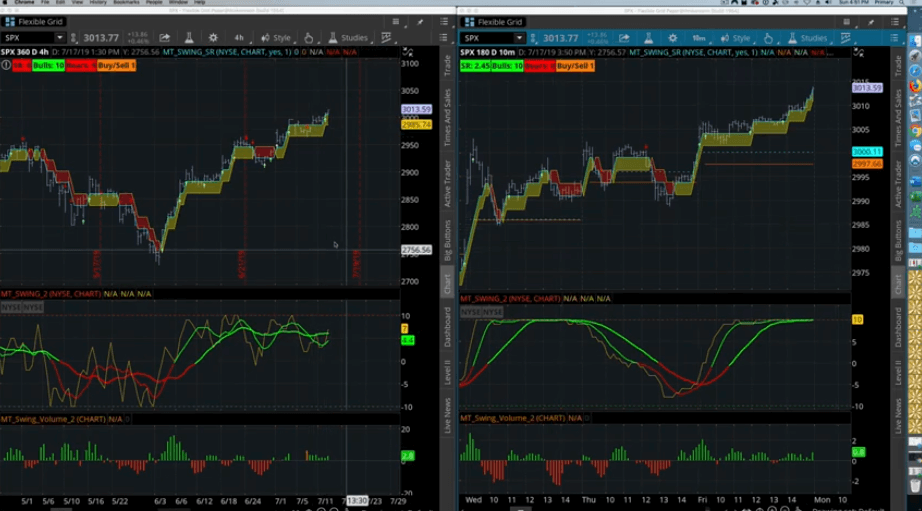

MT Support/Resistance (SR) Study. The MTSR study has 4 components: (1) Bull/Bear Spread: Measures and identifies bullish/bearish sentiment in an easy to read scoreboard; (2) Support/Resistance Band Algorithm; Dynamically paints SR1 an SR2 levels (support/resitance zones) on M10 charts. Also indentifies trends on a “flip” (SR1 above SR2 = bullish; SR1 below SR2 = bearish); (3) Quick view Buy/Sell Signal: +1 = BUY Signal, 0 = Neutral, -1 = SELL Signal. (4) Arrows confirms and identifies the establishment of potential new trends.

Get immediately download Market Timer Swing / Day Trading System

MT Oscillator: MTOSC measures buying and selling activity (money flowing into and out of the market) in real-time on any time frame. Uses a real-time data algorithm (no smoothing or lag) and a 7 and 21 period MA of the real-time algoritm to create a crossover system to identify trends and over-bought and over-sold conditions.

MT Synth Volume: MTSYNTH a synthetic volume indicator. Uses a type of ‘bar analysis’ to determine if that bar is bullish or bearish, we assign a value to that, and then do a cumulative (not average) score to determine if the price action is bullish or bearish. It gives us a real-time indication of what volume whould look like if it was ‘honest’.

MT Renko Cloud: MTRENKO is a variation of a Renko chart, but painted as a cloud. We use it to determine ‘fair value’ areas as shown in the videos below. The goal of this study to elimate the ‘noise’ around market moves and assess when prices are trending too far above or too far below ‘fair value’ areas. The study has an automatic BrickSize with desired number of bars ATR. The ATR Average Type is defaulted to WILDERS, but you can change the script to anything you wish… EMA or SMA etc. WILDERS is the traditional. In other words it takes the last 120 bars average of the ATR. No adjustment is necessary unless you want to use a shorter average number of bars of the ATR.

Readmore: http://archive.li/1uB0m

Be the first to review “Market Timer Swing Day Trading System” Cancel reply

Related products

Stock Forex Options - Trading

Dan Sheridan – Butterflies for Monthly Income 2016 + Iron Condor Methodologies Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Elliott Wave Ultimate (A Must Have Blueprint For Professional Trading Success)

Reviews

There are no reviews yet.