Investopedia Academy – Options for Beginners

$199.00 Original price was: $199.00.$39.90Current price is: $39.90.

Investopedia Academy Options for Beginners Course [Instant Download]

📚 PROOF OF COURSE

1️⃣. What is Options for Beginners:

The Options for Beginners course by Investopedia Academy provides practical strategies to enhance your trading portfolio with options. The course introduces essential terms and skills like calls and puts, risk management, expiration dates, and intrinsic vs. time value. Learn to approach calls as down-payments and puts as insurance while mastering key breakeven calculations.

With over five hours of video lessons, exercises, and interactive content, you’ll be well-prepared to understand and manage options trading. Improve your ability to identify opportunities with comprehensive workbooks and a free Excel spreadsheet for option valuation over time.

2️⃣. What you will learn in Options for Beginners:

- Understanding Options Fundamentals: Develop a foundational understanding of options trading by learning core terminology and concepts like intrinsic and time value, providing a strong starting point for further study.

- Enhancing Portfolio Flexibility: Learn how to incorporate options into your investment portfolio to improve flexibility, using calls and puts strategically for hedging or amplifying returns.

- Calls and Puts Strategies: Understand how to treat calls as down-payments for potential gains and puts as insurance against losses. Learn the differences between buying and selling calls and puts, and the best times to employ each strategy.

- Expiration Dates and Option Value: Learn to interpret expiration dates and differentiate intrinsic from time value to make well-informed options trading decisions.

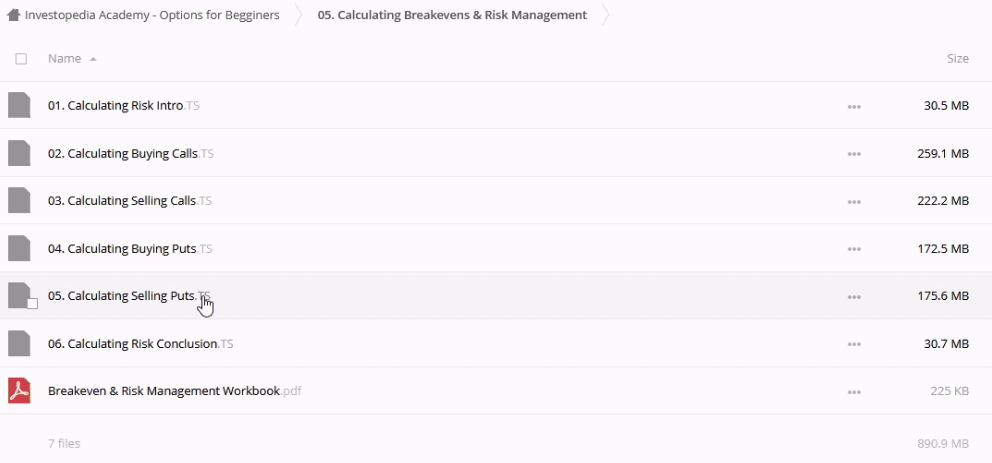

- Breakevens and Risk Management: Master breakeven calculations and implement practical risk management strategies to identify profitable trades while mitigating potential losses.

- Comprehensive Exercises and Tools: Access over five hours of video lessons, exercises, and interactive content, along with a free Excel spreadsheet to calculate option values over time.

- Patient Analysis and Timing: Develop patience by understanding volatility and how timing impacts your options trading strategies.

- Four Trade Setups: Learn strategies like selling calls and puts for income, using puts for protection, and implementing calls for stock replacement.

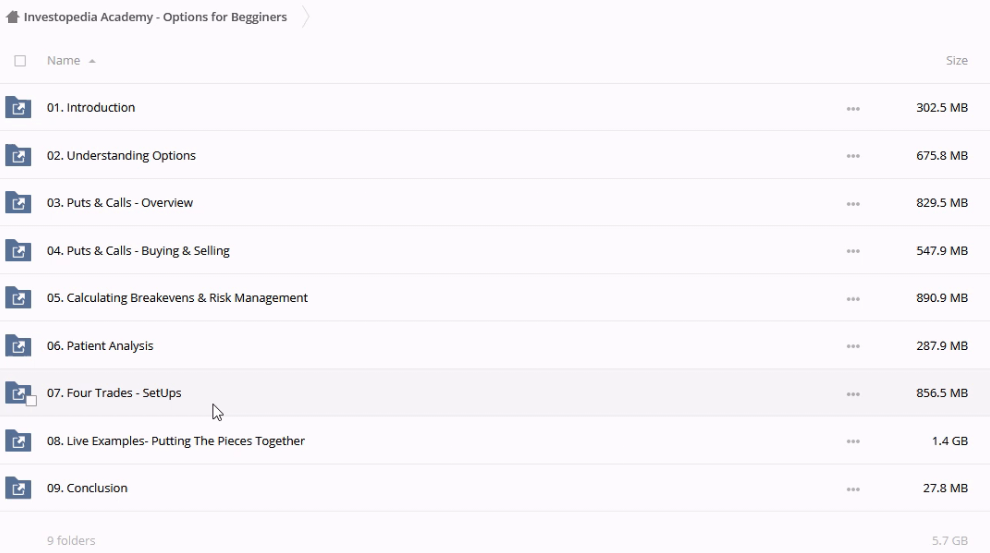

3️⃣. Options for Beginners Course Curriculum:

- Module 1: Introduction

- Module 2: Understanding Options

- Module 3: Puts & Calls – Overview

- Module 4: Puts & Calls – Buying & Selling

- Module 5: Calculating Breakevens & Risk Management

- Module 6: Patient Analysis

- Module 7: Four Trades – SetUps

- Module 8: Live Examples – Putting The Pieces Together

- Module 9: Conclusion

4️⃣. Who is Investopedia Academy?

Investopedia Academy is part of Investopedia, a leading financial media website established in 1999 by Cory Wagner and Cory Janssen. Investopedia has become a trusted source for financial education, offering investment dictionaries, advice, reviews, ratings, and comparisons of financial products. As part of the Dotdash Meredith family, Investopedia Academy focuses on providing high-quality educational technology through a range of online courses.

Investopedia Academy’s mission is to empower individuals with the knowledge they need to make informed financial decisions. The academy offers comprehensive courses taught by industry experts, including options trading, personal finance, and more. Investopedia Academy leverages the vast resources and expertise of Investopedia to create engaging, practical, and accessible learning experiences for beginners and experienced traders alike.

5️⃣. Who should take this course?

The Options for Beginners course is designed for:

- Intermediate Traders: Those with some trading experience looking to expand their knowledge.

- Experienced Traders: Traders seeking to enhance their options trading strategies.

- Individuals with a Brokerage Account: A prerequisite to fully benefit from the course material.

6️⃣. Frequently Asked Questions:

Q1: What are the basics of options?

Options are financial instruments that give you the right, but not the obligation, to buy or sell an asset at a specific price before a certain date. There are two main types: calls and puts. Calls give you the right to buy, and puts give you the right to sell.

Q2: What are puts and calls?

Puts and calls are the two primary types of options. A call option allows you to buy an asset at a specified price within a certain period, while a put option allows you to sell an asset at a specified price within a certain period.

Q3: Which option strategy is best for beginners?

For beginners, simple strategies like buying calls or puts are recommended. These strategies are straightforward and allow you to limit your risk to the amount you paid for the option.

Q4: How do you calculate the break-even point?

The break-even point for a call option is the strike price plus the premium paid. For a put option, it’s the strike price minus the premium paid. This calculation helps you know when your trade starts to be profitable.

Q5: What is the time value of an option?

The time value of an option is the extra amount you pay above the intrinsic value due to the time remaining until expiration. It reflects the potential for the option to gain value before it expires.

Be the first to review “Investopedia Academy – Options for Beginners” Cancel reply

Related products

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Market Profile Trading Strategies – Part I + II – Beyond The Basics + Workshop

Stock Forex Options - Trading

Lex Van Dam – Million Dollar Trader + 5 Steps Trading Stock (BONUS)

Stock Forex Options - Trading

Stock Forex Options - Trading

Dan Sheridan – Butterflies for Monthly Income 2016 + Iron Condor Methodologies Trading

Stock Forex Options - Trading

Anton Kreil – Professional Options Trading Masterclass (POTM)

Reviews

There are no reviews yet.