George Antone – Fynanc Academy

$55.00

George Antone Fynanc Academy Course [Instant Download]

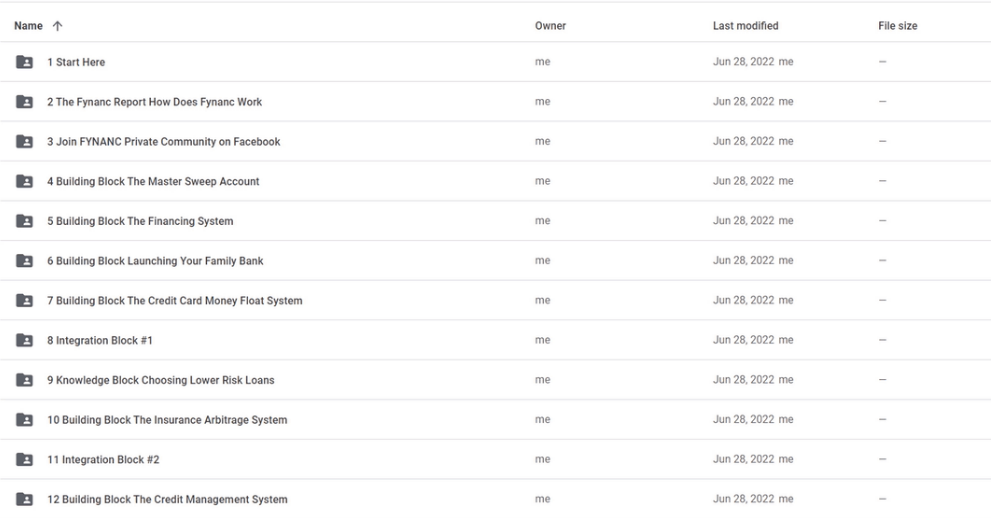

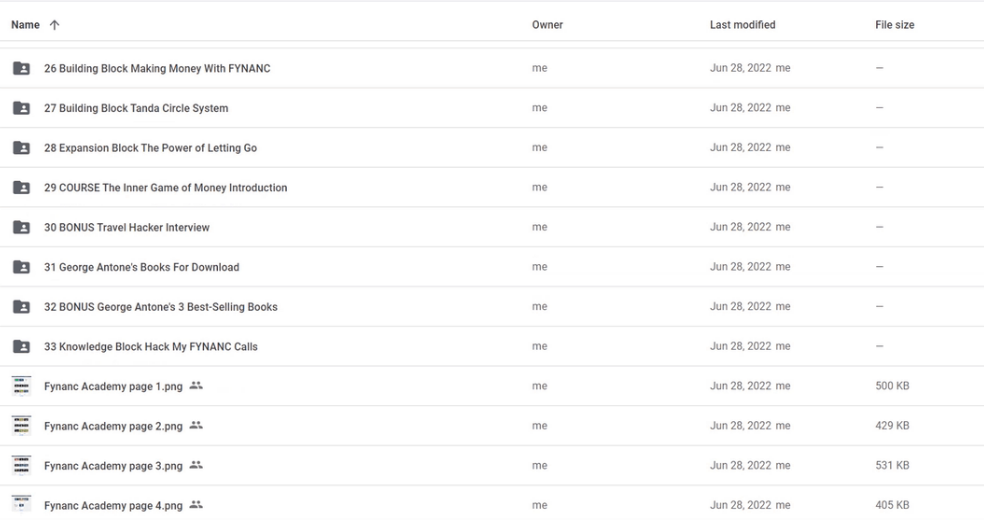

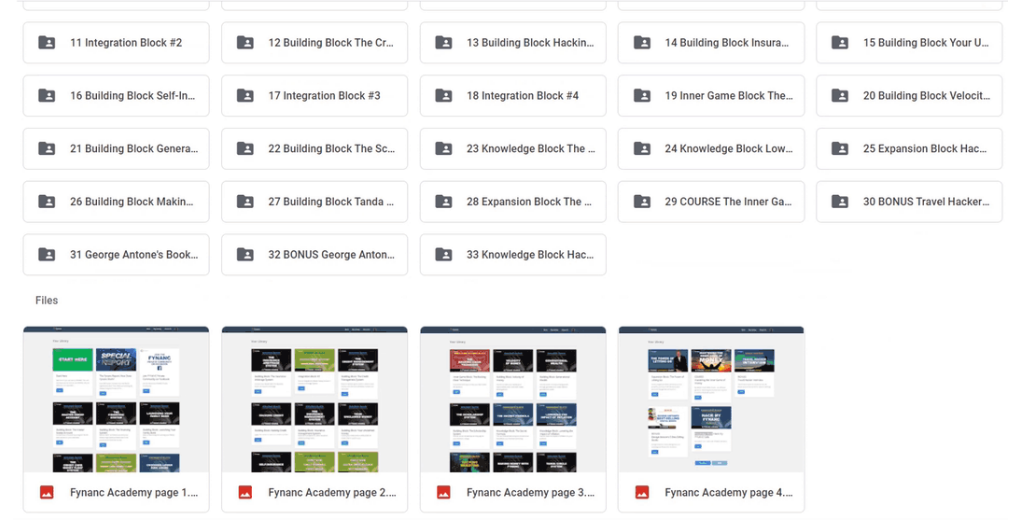

📚 PROOF OF COURSE

1️⃣. What is George Antone Fynanc Academy:

George Antone Fynanc Academy offers a revolutionary approach to financial education, designed to empower individuals to harness the full potential of financial systems and accelerate their journey to financial freedom. At the heart of this course is the expertise of George Antone, a seasoned financial strategist and best-selling author renowned for his ability to decode complex financial landscapes and teach actionable strategies.

Participants will explore a series of legal loopholes and innovative financial techniques that have the potential to significantly improve their net worth. This course doesn’t just impart knowledge; it equips learners with step-by-step guides and access to a supportive community of like-minded individuals, all aimed at implementing what they learn effectively and sustainably.

Whether you’re looking to optimize your personal finances, expand your investment portfolio, or simply gain more financial control, George Antone’s teachings provide the clarity and tools needed to transform financial goals into tangible results.

2️⃣. What you will learn in Fynanc Academy:

In this comprehensive course, students will gain in-depth knowledge and practical skills in various financial disciplines to enhance their economic standing and secure their financial future. Here’s what you’ll learn:

- Understanding Financial Systems: Navigate through the complexities of modern financial systems to find and utilize loopholes legally and advantageously.

- Strategic Investment Techniques: Deploy innovative strategies developed by George Antone to accelerate wealth growth with stability and lower risk.

- Resource Management: Learn how to manage and optimize resources, including credit and insurance, to maximize your financial output.

- Building Personal Financial Infrastructure: Step-by-step guidance on creating robust financial structures such as Family Banks and Sweep Accounts.

- Community and Support: Gain exclusive access to the FYNANC private community, enhancing learning through peer interaction and community support.

- Practical Implementation: Practical application of concepts with downloadable resources, implementation guides, and community support to ensure real-world utility.

The structure of this course is not just about passive learning but about actively creating a foundation that will support your financial advancement for years to come.

3️⃣. Fynanc Academy Course Curriculum:

- Module 1: The Fynanc Report How Does Fynanc Work

- Module 2: Join FYNANC Private Community on Facebook

- Module 3: Building Block The Master Sweep Account

- Module 4: Building Block The Financing System

- Module 5: Building Block Launching Your Family Bank

- Module 6: Building Block The Credit Card Money Float System

- Module 7: Integration Block #1

- Module 8: Knowledge Block Choosing Lower Risk Loans

- Module 9: Building Block The Insurance Arbitrage System

- Module 10: Integration Block #2

- Module 11: Building Block The Credit Management System

- Module 12: Building Block Hacking Credit

- Module 13: Building Block Insurance Management System

- Module 14: Building Block Your Unclaimed Money

- Module 15: Building Block Self-Insurance

- Module 16: Integration Block #3

- Module 17: Integration Block #4

- Module 18: Inner Game Block The Rocking Chair Technique

- Module 19: Building Block Velocity of Money

- Module 20: Building Block Generational Wealth

- Module 21: Building Block The Scholarship System

- Module 22: Knowledge Block The Secret Formula

- Module 23: Knowledge Block Lowering the Impact of Inflation

- Module 24: Expansion Block Hacking Investing

- Module 25: Building Block Making Money With FYNANC

- Module 26: Building Block Tanda Circle System

- Module 27: Expansion Block The Power of Letting Go

- Module 28: COURSE The Inner Game of Money Introduction

- Module 29: BONUS Travel Hacker Interview

- Module 30: George Antone’s Books For Download

- Module 31: BONUS George Antone’s 3 Best-Selling Books

- Module 32: Knowledge Block Hack My FYNANC Calls

4️⃣. Who is George Antone?

George Antone is the founder and CEO of Fynanc LLC, a company known for its innovative financial strategies that help people quickly and safely increase their wealth. He developed Quicken, the first major personal finance software, making it easier for everyone to manage their money.

George is also a best-selling author and a well-known speaker at financial and real estate events across the country. He has spent nearly two decades teaching people how to invest wisely and achieve financial success through his courses and books.

Fynanc Academy, led by George, offers courses that teach valuable techniques to exploit financial systems legally and enhance your financial standing. His teachings focus on understanding complex financial concepts and applying them in practical ways to build wealth and stability.

With his deep knowledge and easy-to-understand teaching style, George Antone has helped many achieve their financial goals and continues to be a trusted guide in the financial education field.

5️⃣. Who should take this course?

This course is designed for a diverse audience, ranging from novices seeking foundational financial knowledge to seasoned investors looking to refine their strategies. Below are the key groups who would benefit immensely from the Fynanc Academy:

- Aspiring Investors: Learn to navigate and exploit financial systems legally to jumpstart and advance your investment journey.

- Personal Finance Enthusiasts: Individuals looking to meticulously manage and grow personal finances through innovative and low-risk strategies.

- Real Estate Professionals: Real estate agents and investors who wish to integrate cutting-edge financial techniques into their investment decisions.

- Entrepreneurs and Business Owners: Enhance your financial acumen to optimize business operations, reduce risks, and significantly boost profitability.

- Students and Lifelong Learners: Anyone eager to master financial systems and implement strategies that are not commonly taught in traditional education systems.

6️⃣. Frequently Asked Questions:

Q1: What are the 5 steps to financial freedom?

– Create a budget and stick to it, to manage your spending and maximize your savings.

– Build an emergency fund to cover unexpected expenses without going into debt.

– Pay off high-interest debt to free up more money for savings and investments.

– Invest regularly to grow your wealth over time through compounding gains.

– Plan for retirement by maximizing your retirement contributions to secure your financial future.

Q2: What is the 25x rule for retirement?

The 25x rule suggests that you should save at least 25 times your annual expenses before retiring. This rule is based on the idea that withdrawing 4% of your savings each year will sustainably support most individuals’ retirement needs without exhausting their funds.

Q3: What are the 3 building blocks of financial freedom?

– Budgeting: Create a detailed budget to monitor and control your spending.

– Saving: Consistently set aside a portion of your income for future needs and goals.

– Investing: Grow your savings by investing in stocks, real estate, or other assets that can provide returns and build wealth over time.

Q4: What are the 7 steps to financial freedom?

A Comprehensive Guide:

– Assess your financial situation: Understand your total income, expenses, and debts.

– Set clear financial goals: Define what financial freedom means to you and set achievable targets.

– Create a budget and stick to it: Manage your daily finances to avoid overspending.

– Build an emergency fund: Save at least 3-6 months’ worth of living expenses.

– Eliminate high-interest debt: Prioritize paying off expensive debts to reduce interest costs.

– Invest wisely: Utilize a diversified investment strategy to minimize risks and maximize returns.

– Review and adjust your financial plan regularly: Update your strategies and goals as your financial situation changes.

Q5: What is the best way to financial freedom?

Achieving financial freedom involves a combination of smart budgeting, diligent saving, and intelligent investing. Start by thoroughly understanding your financial situation, setting realistic goals, and creating a budget to track and manage your expenses. Prioritize building an emergency fund and paying off high-interest debt. Finally, invest in a diversified portfolio to grow your wealth sustainably. Regularly reviewing your financial plan is essential to adjust your strategies and ensure you are on track to meet your financial goals.

Be the first to review “George Antone – Fynanc Academy” Cancel reply

Related products

Business & Marketing

Business & Marketing

Mother of All E-Commerce Walkthroughs – Building a Brand New e-Com Store

Business & Marketing

Business & Marketing

Business & Marketing

Business & Marketing

Business & Marketing

Business & Marketing

Reviews

There are no reviews yet.