Forex OP – Volume Breakout Indicator

$195.00 Original price was: $195.00.$39.00Current price is: $39.00.

Forex OP – Volume Breakout Indicator

Sale Page: Forex OP – Volume Breakout Indicator

Summary

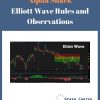

This breakout indicator will detect directional breakouts on high volume. It analyzes the chart to find the times of day when volume and volatility are highest. For major forex pairs this normally coincides with the open of the London market. For commodities it’s usually the start of New York’s trading session.

The indicator will create a buy signal or a sell signal whenever a breakout event is detected during this period. The event time can also be overridden manually.

Example uses:

- Detecting breakouts at the open of London, Tokyo or New York trading sessions

- Trading breakouts on economic data, monetary policy statements and other news

- Trading breakouts at any regular time interval

- Analyzing market behavior and hourly volume/volatility

Directional Breakouts at Peak Volume

Breakout strategies suffer when there are a high proportion of false breaks. Instead of trading on every potential breakout, this indicator looks for the highest probability cases only. The strongest breakout events often happen when volume is rising sharply. These events are often around the opening of the major markets such as London, Tokyo and New York.

The indicator works as follows:

- On loading it will check the price history to find times of peak daily volumes.

- Displays the estimated peak volumes for each hour of the day

- Monitors price movements before and immediately after the peak volume time.

- Creates buy and sell alerts when a breakout has been detected.

This indicator only trades at one specific time of day – the time when volume and volatility is increasing sharply and where breakout events are usually strongest. This breakout strategy is designed for short duration trades only – day trades. The ideal timeframes are 5 minutes to 30 minutes.

Peak Volume

There aren’t any direct volume metrics available for foreign exchange. For this reason the indicator uses volatility analysis to predict times of day when volume is increasing or decreasing.

The graphic below shows volumes for the forex majors over a 24 hour period.

Instead of having the indicator automatically detect peak volumes you can also manually override this and set any time to monitor. For example, this can be useful when trading breakouts on economic data releases.

For examples of volume breakout strategies see this page.

___________________

***** Terms of Sale *****

* After payment, we will send you a link to access and download the course anytime you want.

* We just refund you in case of:

(1) Item is not as described

(2) Item doesn’t work the way it should

(3) Item support is promised but not provided

GRASP COURSE – Partners For Your Success

More Courses: Stock Forex Options – Trading

Be the first to review “Forex OP – Volume Breakout Indicator” Cancel reply

Related products

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

No BS Day Trading (US Markets Webinar 2016) + Starter Course

Stock Forex Options - Trading

Stock Forex Options - Trading

Elliott Wave Ultimate (A Must Have Blueprint For Professional Trading Success)

Stock Forex Options - Trading

Reviews

There are no reviews yet.