Optuma – CMT Level 2 Prep Course

$795.00 Original price was: $795.00.$90.00Current price is: $90.00.

Optuma CMT Level 2 Prep Course (Instant Download)

📚 PROOF OF COURSE

1️⃣. What is Optuma CMT Level 2 Prep Course?

The Optuma CMT Level 2 Prep Course stands as a pivotal resource for those on the journey to mastering the Chartered Market Technician (CMT) Level 2 examination. Crafted with precision and depth, this course is not just a series of lectures; it’s a comprehensive guide designed to navigate through the complexities of technical analysis and market theories.

Updated for the 2017 curriculum, the course unfolds in thirteen thoughtfully structured sessions, each aiming to build your proficiency in different aspects of market analysis. From charting basics, patterns, and oscillators to the intricacies of volume analysis and market models, the course lays a solid foundation. What sets this course apart is its focus on real-world application, preparing you to not only understand but also apply these concepts in market analysis and trading decisions.

Darren Hawkins, MSTA, an Optuma software specialist, enriches the course with his expertise. His video lessons are more than instructional; they are insights gained from years of experience, designed to make complex concepts accessible. Optuma provides a unique blend of theoretical knowledge and practical tools, ensuring that learners can leverage powerful features like scanning and watchlists effectively.

Embarking on this course means investing in your future success. It’s about turning potential into expertise, with the guidance of industry professionals and a commitment to excellence.

2️⃣. What you will learn in CMT Level 2 Prep Course:

This course is tailored to equip you with the knowledge and skills crucial for acing the CMT Level 2 examination. Here’s what you will learn:

- Charting Techniques: Dive deep into the art and science of charting, learning to interpret and apply various chart types and indicators for effective market analysis.

- Averages and Momentum Oscillators: Understand how to use moving averages and momentum oscillators to gauge market trends and make informed trading decisions.

- Trend Systems and Patterns: Master the identification of market trends and patterns, an essential skill for predicting market movements.

- Volume, Open Interest, and Breadth: Learn to analyze volume, open interest, and breadth indicators, enriching your understanding of market strength and sentiment.

- Cycle Analysis: Gain insights into market cycles and their impact on trading strategies.

- Options, Volatility, and VIX: Explore the world of options trading, understanding volatility and the VIX to manage risk and capitalize on market changes.

- Selection of Markets and Issues: Develop the ability to select and analyze different markets and securities, enhancing your versatility as a trader.

- Behavioral Considerations: Understand the psychological aspects of trading and how they influence market behavior.

- Statistics and Intermarket Analysis: Utilize statistical analysis and intermarket relationships to build robust trading strategies.

- Market Models and System Testing: Learn about various market models and the importance of system testing to validate trading strategies.

- Ethics: Embrace the ethical standards required in the trading profession, ensuring integrity and professionalism in your practices.

Each session is designed to build your competency and confidence, preparing you for the CMT Level 2 exam and beyond. The course is more than just exam preparation; it’s a transformation into a well-rounded technical analyst.

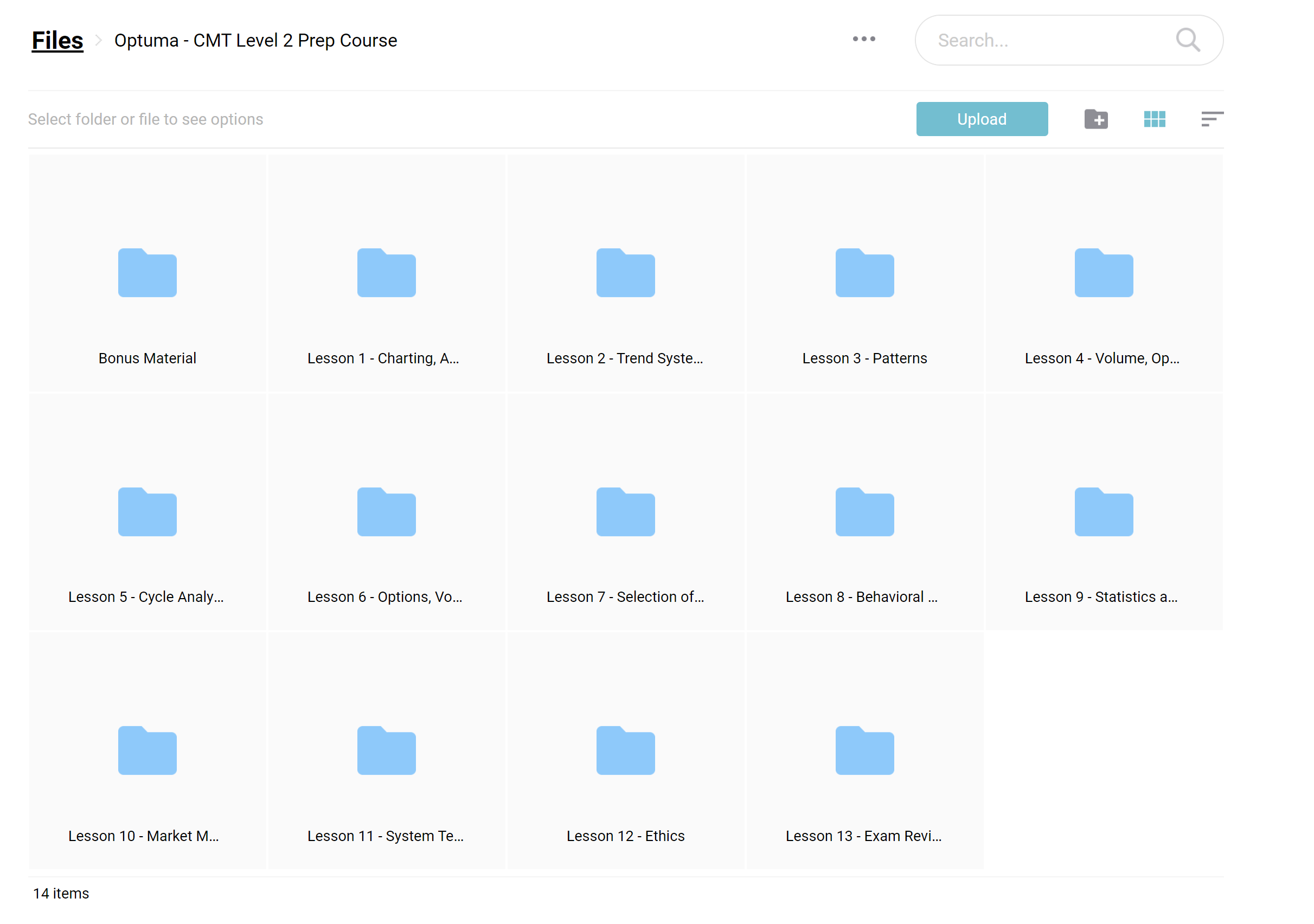

3️⃣. CMT Level 2 Prep Course Curriculum:

The Optuma CMT Level 2 Prep Course is meticulously structured to cover all necessary topics and prepare you thoroughly for the CMT Level 2 exam. Here’s a detailed breakdown of the curriculum:

- Lecture 1 – Charting, Averages and Momentum & Oscillators

- Lecture 2 – Trend Systems

- Lecture 3 – Patterns

- Lecture 4 – Volume, Open Interest, and Breadth

- Lecture 5 – Cycle Analysis

- Lecture 6 – Options, Volatility and VIX

- Lecture 7 – Selection of Markets and Issues

- Lecture 8 – Behavioral Considerations

- Lecture 9 – Statistics and Intermarket

- Lecture 10 – Market Models

- Lecture 11 – System Testing

- Lecture 12 – Ethics

- Lecture 13 – Exam Prep

This curriculum is designed not only to prepare you for the CMT Level 2 examination but also to equip you with a profound understanding of market analysis and trading principles. With comprehensive coverage of each topic and practical insights, you’ll be well-prepared to advance in your career as a technical analyst.

4️⃣. Who is Optuma?

Optuma has been working with the CMT Association since 2014, helping people get ready for the CMT exams. They’re known for making tools that help analysts study for and pass these tests. The CMT (Chartered Market Technician) is a big deal for technical analysts around the world, and Optuma is all about helping them succeed.

Their team includes experts who have passed the CMT exams themselves, so they know exactly how tough the process can be but also how rewarding it is once you pass. One of the key people at Optuma is Mathew Verdouw, who is not just the boss but also a teacher and the person behind their tools. Mathew has been into technical analysis since 1996, meaning he’s really good at understanding and explaining complex ideas in ways that make sense to everyone.

Optuma’s main goal is to help you learn everything you need for the CMT exams and to make sure you can use that knowledge in real life. They’re not just about passing exams; they’re about making you better at your job. With Optuma, you’re getting a team that’s committed to helping you every step of the way.

5️⃣. Who should take this course?

The Optuma CMT Level 2 Prep Course is designed for a diverse group of individuals aiming to deepen their understanding of technical analysis and excel in the CMT Level 2 exam. This course is ideal for:

- Traders: Who seek to enhance their market analysis skills and integrate advanced technical analysis techniques into their trading strategies.

- Analysts: Looking to broaden their analytical toolkit and apply sophisticated charting and analysis methods in their research.

- Finance Students: Who wish to gain a competitive edge in their studies and future careers by mastering practical and theoretical aspects of market analysis.

- Investment Professionals: Eager to add technical analysis to their portfolio of investment strategies and improve their market predictions.

- Career Changers: Interested in entering the finance industry with a solid foundation in technical analysis and market dynamics.

By taking this course, participants will not only prepare for the CMT Level 2 exam but also acquire skills that are valuable in various finance-related roles, making it a worthwhile investment for anyone looking to advance in the field of technical analysis.

6️⃣. Frequently Asked Questions:

Q1: How do you analyze a technical chart?

Analyzing a technical chart involves identifying patterns, trends, and key levels of support and resistance. Traders also look at indicators and oscillators, like moving averages or RSI, to gauge market sentiment and potential direction changes. The goal is to use historical data to predict future price movements

Q2: How long does it take to clear CMT?

Clearing the entire CMT certification typically takes between 18 to 24 months, depending on your study pace and exam scheduling. For Level 2 specifically, candidates often invest several months in preparation to thoroughly understand and apply the course material.

Q3: Which is better, CFA or CMT?

Choosing between CFA (Chartered Financial Analyst) and CMT (Chartered Market Technician) depends on your career goals. CFA is geared towards investment management and in-depth financial analysis, while CMT focuses on technical analysis and market theory. Both are valuable, with the best choice reflecting your interest in quantitative analysis versus market behavior.

Q4: What is CMT technical analysis?

CMT technical analysis involves the study of market data, primarily price and volume, to forecast future market behavior. This approach assumes that historical trading activity can indicate future trends, making it a cornerstone of the CMT curriculum.

Q5: What are ethics in trading?

Ethics in trading refer to the moral principles that guide the behavior of traders and analysts. This includes integrity, honesty, and fairness in market dealings, and adherence to legal and regulatory standards. Ethical trading ensures trust and transparency in the financial markets, protecting the interests of all market participants.

Be the first to review “Optuma – CMT Level 2 Prep Course” Cancel reply

Related products

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Market Profile Trading Strategies – Part I + II – Beyond The Basics + Workshop

Stock Forex Options - Trading

Stock Forex Options - Trading

No BS Day Trading (US Markets Webinar 2016) + Starter Course

Stock Forex Options - Trading

Stock Forex Options - Trading

Elliott Wave Ultimate (A Must Have Blueprint For Professional Trading Success)

![Oil Trading Academy - Code 1 + 2 + 3 [Video Course]](https://graspcourse.net/wp-content/uploads/2019/07/Oil-Trading-Academy-Code-1-2-3-Video-Course-300x400.jpg)

Reviews

There are no reviews yet.