Karla Dennis – Tax Reduction Strategy Program

$997.00 Original price was: $997.00.$86.00Current price is: $86.00.

Karla Dennis Tax Reduction Strategy Program Course [Instant Download]

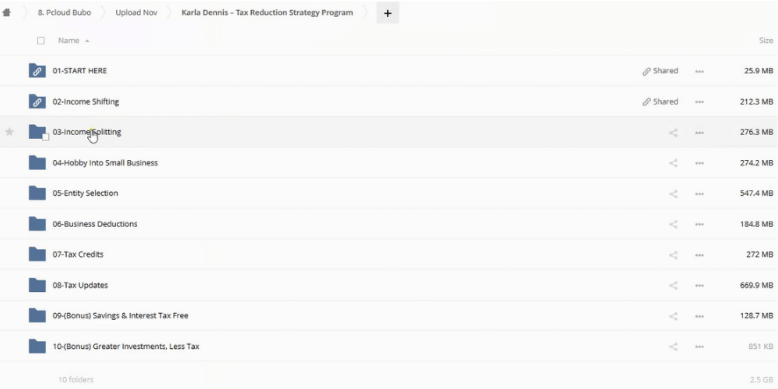

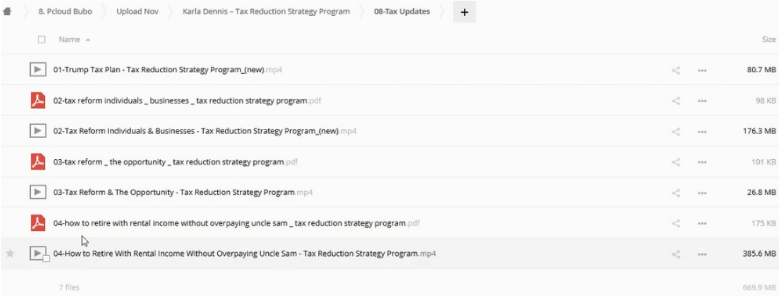

📚 PROOF OF COURSE

1️⃣. What is Karla Dennis’ Tax Reduction Strategy Program:

Karla Dennis’ Tax Reduction Strategy Program offers a comprehensive roadmap to legally minimizing your taxes. This course empowers real estate investors and small business owners with actionable strategies that harness Karla’s extensive experience and in-depth knowledge of tax laws. By integrating practical tools and insights, this program helps participants transform their financial approaches, ensuring they maximize their savings without leaving “a tip” for Uncle Sam. Each module is designed to break down complex tax codes into understandable, executable steps that can be applied immediately.

This course isn’t just about learning; it’s about applying knowledge in ways that make a tangible difference in your financial life. Whether you’re looking to convert a hobby into a lucrative business or optimize your current business structures for better tax efficiency, Karla’s program provides the tools and support needed to achieve your goals.

2️⃣. What you will learn in Tax Reduction Strategy Program:

- Turn a Hobby Into A Small Business: Discover how to transform personal passions into profitable ventures while enjoying tax advantages.

- Entity Selection: Gain clarity on choosing the best business structure—LLC, C-Corp, S-Corp, or Partnership—to minimize taxes and enhance business operations.

- Maximize Business Deductions: Learn strategies to identify and claim more business expenses, significantly reducing taxable income.

- Income Splitting: Understand how to legally split income within your family to lower tax obligations and protect your wealth.

- Income Shifting: Master the art of using multiple business entities to shift income and reduce taxes.

- Tax Credits: Uncover ways to qualify for tax credits that can reduce your tax bill or even yield a refund.

3️⃣. Tax Reduction Strategy Program Course Curriculum:

The Tax Reduction Strategy Program is meticulously structured to guide you through a series of educational modules, each designed to build upon the previous, ensuring a comprehensive understanding and application of tax reduction strategies. Here’s what each module covers:

- Module 1: Turn a Hobby Into A Small Business

Learn the legal nuances of converting your hobby into a recognized business to exploit tax benefits. - Module 2: Entity Selection

Detailed analysis on the pros and cons of various business entities like LLCs, C-Corps, S-Corps, and Partnerships. This module helps you make informed decisions about the best structure for your business. - Module 3: Maximize Business Deductions

Strategies to identify potential tax deductions in everyday business expenses, teaching you how to maximize deductions without additional spending. - Module 4: Income Splitting

Explore techniques for distributing income among family members to reduce overall tax liability, a common strategy among the wealthy. - Module 5: Income Shifting

Advanced strategies on using multiple business entities to shift income legally and reduce taxes. - Module 6: Tax Credits

Discover how to utilize tax credits effectively to reduce the amount of taxes owed or to receive substantial refunds.

Bonus Material:

- Tax Saving & Interest Module: Learn to save and grow your money with interest in a tax-efficient manner.

- Private Facebook Group: Access to a community of like-minded individuals and expert advice from Karla’s team.

- Greater Investments & Less Tax Book + Workbook: Insights into making smart investments with high returns while minimizing taxes.

This curriculum not only educates but also equips you with the tools needed to implement what you learn immediately, ensuring you can start saving on taxes as soon as possible.

4️⃣. Who is Karla Dennis?

Karla Dennis is an acclaimed Tax Strategist and Enrolled Agent, renowned for her expertise in tax planning and business development. With a Master’s degree in Taxation and Business Development, Karla has transformed her deep understanding of tax laws into practical, effective strategies that help individuals and businesses significantly reduce their tax liabilities legally and ethically.

Karla’s journey in the tax field began uniquely; rather than entering a traditional CPA firm after college, she opted to work at a Tax Law Firm. This experience was pivotal, as it allowed her to see the distinction between merely doing taxes and strategically planning to minimize them. Her exposure to real-world business tax strategies spurred her to further her education and ultimately led her to establish Karla Dennis and Associates. Today, her firm boasts over 20 employees and serves clients across all 50 states, helping them save thousands of dollars each year.

Her professional accolades include authoring two insightful books, “Tax Storm” and “Against the Odds,” which further cement her authority in the tax field. Karla’s success and innovative tax reduction methods have earned her features in prominent media outlets such as Forbes, MSNBC, KTLA, Yahoo! Finance, and SmartMoney.

Karla’s personal investment experience as a real estate investor gives her a unique perspective, enabling her to offer specialized tax strategies to other investors and business owners. Her approach is not only about compliance but optimizing tax strategies to enhance business efficiency and growth.

5️⃣. Who should take this course?

Ideal for:

- Real Estate Investors: Tailored strategies to maximize your investment returns while minimizing tax liabilities.

- Small Business Owners: Learn how to leverage tax laws to your advantage, turning everyday expenses into significant deductions.

- Entrepreneurs Interested in Tax Optimization: Whether you are starting a new business or optimizing an existing one, this course provides essential strategies for tax reduction.

- Individuals Seeking to Transform Hobbies into Businesses: Uncover the steps and legal pathways to convert personal passions into profitable, tax-efficient businesses.

This course is designed for anyone looking to make informed decisions about taxes and maximize their potential savings. Whether you are a seasoned business owner or just starting, Karla’s insights will provide valuable strategies to enhance your financial outcomes.

6️⃣. Frequently Asked Questions:

Q1: What is entity selection?

Entity selection refers to the process of choosing the type of business structure for your company, such as an LLC, S-Corp, C-Corp, or Partnership. The choice impacts how you are taxed, your legal liabilities, and your business operations. It’s essential to select the entity that best fits your tax and business goals.

Q2: What is the difference between income splitting and income shifting?

Income splitting involves dividing income among several family members or legal entities to fall into lower tax brackets, thus reducing the overall tax burden. Income shifting, however, refers to moving income from one entity to another, often to take advantage of lower tax rates or more favorable tax laws.

Q3: What are tax credits?

Tax credits are amounts that can be subtracted directly from the taxes you owe, on a dollar-for-dollar basis. They are designed to encourage specific behaviors like investing in renewable energy, education, or hiring certain employees. Knowing which tax credits you qualify for can significantly lower your tax bill.

Q4: How do big businesses avoid tax?

Big businesses often use strategies such as locating parts of their operations in low-tax jurisdictions, making use of various legal deductions and credits, employing income shifting among international subsidiaries, and leveraging tax treaties. These strategies are lawful and require deep knowledge of tax laws.

Q5: How can education reduce your taxes?

Education can reduce your taxes through various deductions and credits for eligible expenses. These include the American Opportunity Credit, Lifetime Learning Credit, and others that cover costs like tuition, fees, books, and equipment. Claiming these benefits can lower your taxable income and increase your tax refund.

Be the first to review “Karla Dennis – Tax Reduction Strategy Program” Cancel reply

Related products

Stock Forex Options - Trading

Anton Kreil – Professional Options Trading Masterclass (POTM)

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Stock Forex Options - Trading

Reviews

There are no reviews yet.