Dan Sheridan – Options Foundations Class

$397.00 Original price was: $397.00.$58.00Current price is: $58.00.

Dan Sheridan Options Foundations Class Course [Download]

1️⃣. What is Options Foundations Class:

Dan Sheridan’s Options Foundations Class is designed to empower you with the tools needed to establish a profitable options trading business.

This course delves into essential trading strategies like volatility, the Greeks, and various spread tactics, all structured to generate consistent monthly income. Perfect for both beginners and seasoned traders, this course offers practical knowledge accessible through a series of detailed video lessons.

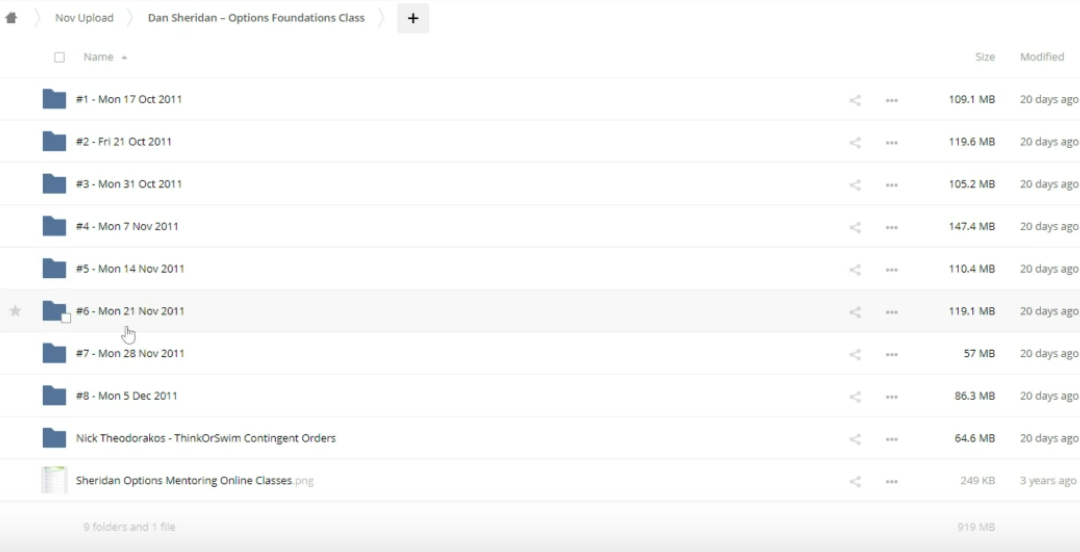

📚 PROOF OF COURSE

2️⃣. What you will learn in Options Foundations Class:

In the Options Foundations Class, you will gain deep insights into the critical components of options trading:

- Understand Volatility: Learn how market dynamics affect options trading and how to use volatility to your advantage.

- Master the Greeks: Get to grips with Delta, Gamma, Theta, and Vega to manage your trades effectively.

- Explore Spreads: From basic to complex, discover how to set up and adjust various options spreads.

- Specialize in Covered Calls and Butterflies: Apply these techniques to enhance your trading strategy.

- Calendar Spreads: Utilize time decay in different contracts for profitable opportunities.

- Strategies for Long-term Success: Develop long-term trading strategies that sustain profitability.

3️⃣. Options Foundations Class Course Curriculum:

The curriculum of the Options Foundations Class is comprehensive and designed to take you through every aspect of options trading:

- Class 1– Foundational Concepts, the Greeks & Live Execution, Picking a Broker, Commissions

- Class 2– Introduction to Spreads and Adjustments

- Class 3– Volatility

- Class 4– Credit Spreads & Iron Condors

- Class 5– Calendars

- Class 6– Butterflies

- Class 7– Long-term Strategies

These sections are crafted to ensure each learner gains practical skills and theoretical knowledge, supported by real-world applications. The Options Foundations Class offers an extensive curriculum that systematically builds your understanding of critical options trading concepts.

Starting with foundational theories including the Greeks and broker selection, the course progresses through practical strategies like spreads, volatility, and specialized trades. Each class not only teaches the theory but also includes practical live execution tips, ensuring you’re ready to apply what you learn directly to your trading activities.

4️⃣. Who is Dan Sheridan?

Dan Sheridan is a distinguished figure in the world of options trading, boasting over 25 years of experience. A former CBOE market maker, he started his career at Mercury Trading, learning under the tutelage of options pioneers Jon and Pete Najarian.

After leaving the trading pits in 2004, he founded Sheridan Mentoring, dedicating his career to educating aspiring traders. Under his guidance, students learn not just to trade, but to build lasting trading businesses, leveraging techniques that Dan used daily in the pits.

His commitment to education is reflected in the positive reviews Sheridan Mentoring has garnered online, making him a trusted mentor in the trading community.

5️⃣. Who should take this course?

- Entrepreneurs: Looking to diversify their income streams through trading.

- Aspiring Traders: Beginners seeking a comprehensive foundation in options.

- Experienced Investors: Those aiming to refine and expand their trading strategies.

- Career Changers: Individuals seeking profitable skills in a high-demand financial sector.

- Financial Professionals: Wanting practical strategies to enhance client portfolios.

This course is tailored for anyone who aims to master the art of options trading, whether starting from scratch or expanding existing skills.

6️⃣. Frequently Asked Questions:

Q1: What is the best option strategy for monthly income?

The most reliable strategy for consistent monthly income is selling covered calls or cash-secured puts. These strategies allow you to generate earnings from premiums while managing risk.

Q2: How much do I need to invest to make $1000 a month?

The investment required to generate $1000 a month varies based on your strategy and the market conditions. However, with options trading, strategies like covered calls can be a practical approach depending on the underlying asset and the market volatility.

Q3: What is the safest option income strategy?

The safest option income strategy often involves selling covered calls. This strategy allows you to earn income from the option premiums while reducing risk, as you hold the underlying stock.

Q4: How do you trade in low volatility?

In low volatility, strategies such as iron condors or butterfly spreads can be effective. These strategies profit from the market’s stability and can provide steady income with controlled risk.

Q5: What is the best investment for a monthly income?

Options trading offers several strategies for generating monthly income, with covered calls being among the most popular for their balance of risk and return. This strategy involves holding a stock and selling a call option to collect premiums.

Be the first to review “Dan Sheridan – Options Foundations Class” Cancel reply

Related products

Stock Forex Options - Trading

Stock Forex Options - Trading

Lex Van Dam – Million Dollar Trader + 5 Steps Trading Stock (BONUS)

Stock Forex Options - Trading

Stock Forex Options - Trading

Market Profile Trading Strategies – Part I + II – Beyond The Basics + Workshop

Stock Forex Options - Trading

Stock Forex Options - Trading

Anton Kreil – Professional Options Trading Masterclass (POTM)

Stock Forex Options - Trading

Stock Forex Options - Trading

Dan Sheridan – Butterflies for Monthly Income 2016 + Iron Condor Methodologies Trading

![Oil Trading Academy - Code 1 + 2 + 3 [Video Course]](https://graspcourse.net/wp-content/uploads/2019/07/Oil-Trading-Academy-Code-1-2-3-Video-Course-300x400.jpg)

Reviews

There are no reviews yet.